Blog •

Posted on Mar 28, 2023

Finances For Freelancers 101

About the author

Reedsy's editorial team is a diverse group of industry experts devoted to helping authors write and publish beautiful books.

More about the Reedsy Editorial Team →Linnea Gradin

The editor-in-chief of the Reedsy Freelancer blog, Linnea is a writer and marketer with a degree from the University of Cambridge. Her focus is to provide aspiring editors and book designers with the resources to further their careers.

View profile →This blog post is based on a webinar from April, 2020 where Grace Taylor from gracefullyexpat.com — an enrolled agent authorized to practice before the IRS, 3-time expat, and digital nomad — breaks down the basics of freelancer finances.

For more information, check out our webinar on managing your finances and UK Freelancer Taxes or how to do your freelance taxes.

It has been edited for length and clarity. You can watch the full webinar below:

Skip to 1:52 for the start of the talk.

In my professional practice, I work with people based all around the world who are, primarily, freelancers, entrepreneurs, or in some way self-employed. I’ve had exposure to a few different national tax systems but I’m Canadian, and my professional credentials are US-specific, so that’s where my expertise lies. However, in this webinar, I will try to give a global perspective on finances where I can, looking at how to track your income and expenses, file your taxes, and save for retirement, with some general examples from other anglophone countries.

👆 I always like to give a disclaimer that this is not tax advice in any way, shape, or form. This is for general, informational purposes only. If you need specific advice, you are strongly encouraged to seek out your own, independent tax advisor.

Let’s start by looking at what a freelancer actually is, and how it differs from being a regular, salaried employee.

Freelance vs employed

The definitions for a ‘freelancer’ and ‘employee’ differ from country to country, but in general, someone who is an ‘employee’ would be on a payroll and have tax withheld from their paychecks. Normally, they work for one company and that company directs their schedule and tasks. In contrast, someone who is ‘freelance’ or ‘self-employed’ might invoice individually by project or for their time. They might have multiple clients that they work with and direct their own schedules.

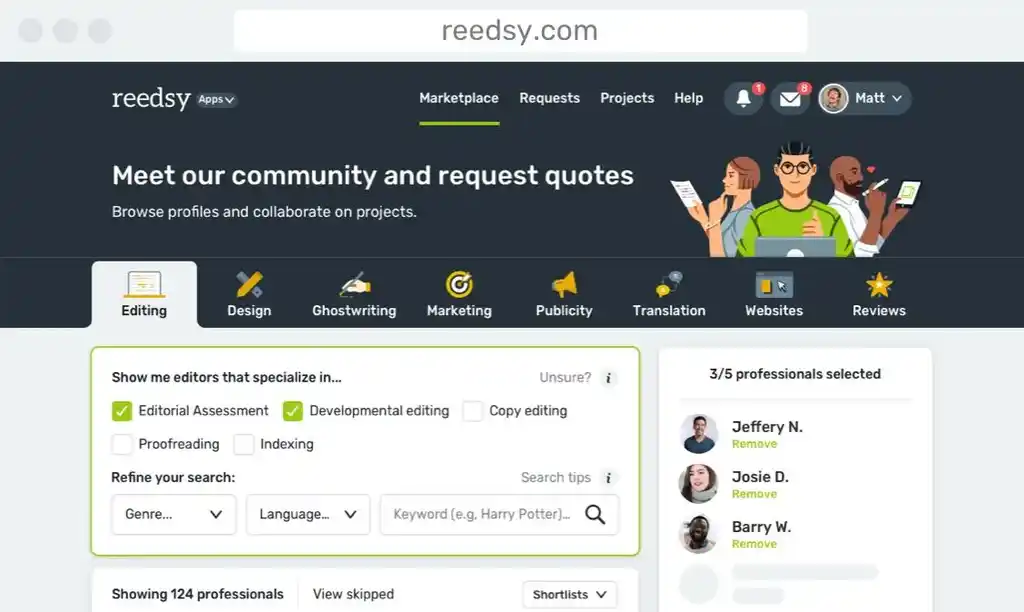

JOIN REEDSY

Find exciting new projects

We connect publishing professionals with our community of 1,500,000 authors.

A business of one — freedom with responsibility

Importantly, freelancers are responsible for their own tax reporting. We'll talk a little more about what that means later. But in general, many countries look at that person like a business of one.

There are a few different terms that you can use that mean ‘freelancer’ or ‘self-employed’, like:

- Sole proprietor — accounting word for someone who doesn’t have a formal business structure

- Sole trader — common in the UK

- Independent contractor — common in the US

One of the major advantages of being a freelancer is that you have the ability to set your own rates and dial up your income. As a freelancer, you can take on more clients and more projects, but you also have the responsibility to actively manage your taxes and personal finances. I encourage people to think of themselves as a business of one and everything that entails: from cash flow management to budgeting and expense tracking.

Tracking your income

The first logical step would be tracking your income and understanding what’s reported on your behalf.

Keeping track of revenue sources

My clients sometimes ask me, “How do I find out exactly how much I made last year?” and the reason why they might not know the answer is that perhaps they have different clients who pay them through different sources — from Wise, to PayPal, to direct bank transfers — and perhaps in different currencies. So it can be a bit of a challenge to figure out exactly how much you made and how much you need to report as a revenue.

💸 Note: On the Reedsy marketplace, invoicing and receipts are made easy as publishing professionals are paid via Stripe, automatically distributing the earnings into your account once the payment has been cleared. Together with your client, you can decide when and how you want to be paid — upfront; after delivery; once, in full; or in installments.

In some countries you might get a tax slip — it’s called the 1099-miscellaneous (1099-MISC) in the US — and that’s basically the income that was reported on your behalf to the national revenue agency so that you know how much to report on your taxes. If you have a 1099 from a client that says they paid you $20,000 last year, but you only report $10,000 on your tax return, there will obviously be a mismatch with the IRS, so it's important to note if anything's being reported on your behalf and how it is being reported.

Separate bank accounts

If my clients find it overwhelming to have business and personal expenses together in one account, I always suggest setting up a separate bank account for their freelancing income and expenses. Do make sure you have what you need to open a bank account as a freelancer, such as your ID, proof of business registration, and any personal details required.

🗂️ Having two separate bank accounts for your personal and business transactions can help you keep track of your finances and keep things neat and organized — something you will appreciate once it’s time to report your taxes.

Currencies

Many of my clients are digital nomads and expats located all over the world, so they’re often invoicing clients in different currencies. But whenever you're tracking your freelance income and expenses and reporting your taxes, you have to convert it all back to your base currency.

✈️ Freelancing = mobility. As a freelancer, you can often work on the road — or even travel the world with the circus (!) like Reedsy designer Sarah Lahay does.

In terms of exchange rates, my biggest advice is to be consistent. Don't choose exchange rates arbitrarily: check whether your country’s revenue agency offers some guidance and follow that. You also need to keep some documentation of which rate you used, whether it was a spot rate on that day or an average rate for that year (the US, for example, publishes yearly average rates). I use xe.com or oanda.com, and then you can keep a link to remind yourself why you chose that rate.

Tracking your expenses

Once you have your gross income, the next step is to look at whether you have any deductible business expenses. Depending on the nature of your freelancing income, you may not have that many expenses, but if you do and they’re deductible, it’s in your interest to make sure it’s done correctly.

What is deductible?

At a very high level — and this is probably true in most countries — expenses are deductible if they are necessary for you to generate your income and primarily or exclusively used for business purposes.

For example, people sometimes ask me if they are allowed to deduct expenses if they bought a suit to go to a client meeting. The IRS says no, because they argue that you can get use out of that suit elsewhere in your life. It’s not specifically for business, whereas if you have to buy some type of uniform which you can’t use outside of your work, then that cost is probably deductible.

🤡 If you’re a freelancing clown and need a clown costume to entertain at birthday parties, you may be allowed to deduct the cost when you declare your taxes. Or, if you’re a designer who needs to pay for InDesign and other tools or programs, you can likely deduct those expenses when you file your taxes.

Here’s what official sources have to say about deductible business expenses in some anglophone countries:

| USA | Expenses must be ‘ordinary and necessary’ |

| UK | Examples of deductible expenses: office costs, travel costs, financial costs, training, marketing. |

| Canada | Personal expenses are not deductible |

| Australia | Most expenses directly related to earning income are allowable. |

This information is publicly available but, as you can see, authorities often shy away from giving you an itemized, line-by-line list of deductible expenses. That’s because it differs so widely based on what business you're in. You have to be proactive and look it up or seek guidance if you're not sure. And again, remember to keep proper records and documentation, like invoices and receipts for any business-related expenses.

FREE RESOURCE

Invoice Template

Provide billing and payment details with this professional template.

Keeping track of expenses

For most people, it’s enough to track your expenses with some type of spreadsheet. You can also use software programs — there are various ones available online — but you have to use them consistently because the results are only as good as your input. If you’re expecting a set-it-and-forget-it solution, it unfortunately doesn’t work that way, especially if you’re using the same card to pay for your daily coffee as you’re using for your business expenses. The software can’t tell what expenses are for your business or not.

In terms of record keeping, I would suggest checking with your country's tax authority. In most cases, electronic copies of invoices and receipts will be sufficient.

💡If you can track expenses digitally, scan or upload photos of your receipts to keep a record.

Once you have your gross income and you know what your business expenses are, you have what is called a net taxable income: your profit as a freelancer before taxes. Now you’re ready to report your taxes and calculate your net profit: your earnings after taxes.

Reporting your taxes

There are a few specific pitfalls and tips that self-employed individuals need to know when it comes to reporting taxes. In general, you can assume that your tax reporting is going to be a bit more complicated than that of your regularly employed counterparts.

There are three things you need to check for your country:

- If you need to register as self-employed with the relevant tax office.

- If you need to file a different tax form — or file a tax return in general.

- If you need to prepay your tax as you go, in installments, or quarterly estimates.

Here are what authorities in some anglophone countries say:

|

Country |

Need to register? |

Special tax form? |

Prepay taxes? |

|

USA |

No |

No (but include schedule C)* |

Yes |

|

UK |

Yes** |

Yes, self-assessed |

Yes |

|

Canada |

No |

No |

Yes |

|

Australia |

No |

No (but include business schedule) |

Yes, PAYG |

*Triggers potential self-employment tax

**In the UK (and Ireland), your taxes are automatically calculated for employed individuals. However, if you’re self-employed, you need to register as such and file a separate, self-assessed tax return.

Prepaying your taxes in installments

In the US (as in many other countries), it’s highly suggested that you pay your self-employment tax and your tax in installments throughout the year. When you’re self-employed, the revenue office doesn’t know how much you’re earning and doesn’t have access to the withheld tax as they would if you were on a payroll, but it’s in their interest to receive preliminary taxes from you, based on what you think you will earn in total that year. So they have a system where, if you don’t pay your taxes in installments, you can become subject to what’s called ‘underpayment penalties’. If you end up earning more or less than the prepaid amount, you will either have to pay additional taxes or receive a tax refund.

📁 Looking for tips on how to file your taxes in the US? Check out our blog post on freelancer taxes.

Lastly, you’ll want to look into some options for retirement savings.

Saving for retirement

When I think about retirement savings, I think about it in three pillars: to begin planning your retirement, you’ll want to look into how your self-employment tax contributions factor into the potential benefits you receive from the state pension in your country; what tax advantage saving schemes are available for self-employed workers in your country; and then, if you have additional funds, you can look at other, private savings and investment schemes.

|

Country |

Where to check |

Tax-advantaged schemes |

|

USA |

|

|

|

UK |

|

|

|

Canada |

|

|

|

Australia |

|

*If you’re self-employed, you can register for both IRA schemes at once

** Many people use HSAs for general retirement savings.

If saving for your retirement seems confusing, do reach out to the relevant sources for more information — whether it’s a bank or a financial institution — where they might be able to point you in the right direction. Once you know the right terminology to use, that can get you on the path forward.

Q&A session

If you have clients in two or more countries, do you have to report taxes to both respective countries?

I can't speak to the tax rules in every country, but you generally don’t have to. Most countries base it on where you’re a resident and where you’re performing that work. For example, I have clients from all over the world, but I live and do my work in Ireland, so I report all of my taxes to the Irish revenue. It’s the same for the US, where you report everything to the IRS.

♻️Taxes are generally a way for a country to invest in services that the wider public and residents of that country can benefit from, such as infrastructure. Thus, you pay taxes in the country where you are registered, where you can directly or indirectly benefit from those services.

It can get a little bit complicated if you are very mobile and you spend six months in the UK and six months in the US. Then there's a good chance that you might have to report to both countries. In that situation, I would suggest that you seek out some tax advice from both countries. But at a high level, if you have a client in France, but you’re working from Ireland, you’re generally only reporting in Ireland.

If you travel very frequently or full-time and don’t spend a significant time in any country, where would you pay taxes?

Everything depends on where you're a citizen. If you're a US citizen, you are always reporting 100% of your worldwide income on the US tax return. If you are not a US citizen, then it comes down to your residency status.

To calculate your residency status, you have to look at the number of days that you've been in the country versus outside. If you're considered a US resident, even if you're not a citizen, you report worldwide income during your US residency period. If you are not a US resident, then you only report US source income.

At a really high level, as a US citizen you're always reporting worldwide income. Everybody else should, first and foremost, look at what their residency status is for tax purposes.

FREE RESOURCE

The Full-Time Freelancer's Checklist

Get our guide to financial and logistical planning. Then, claim your independence.

If you move countries every few years and you don’t know where you're going to retire, what advice would you give?

There are a few things to consider in that situation. Those who move frequently have to do a little bit more of their own tracking and legwork. For instance, I lived in the US for a while and I paid into US social security, so I'm keeping an eye on what I’ll be eligible for there, even if I happen to retire back in Canada or here in Ireland. I suggest that you have a system in place to track what you've paid into each country’s scheme.

Also, be aware that most ‘developed countries’ have what's called a “totalization agreement”, which means that if you’re paying into one system but retire in another country, you can combine the credits. If your total combined credits from the countries that you’ve worked in exceed the minimum threshold, then you’re still eligible regardless of what country you retire in. So have a look at whether the countries that you’ve lived and worked in have this social security totalization agreement.

Should one consider reporting as an LLC or is reporting as an individual better?

I’m going to answer this from a US perspective, since I don’t know the ins and outs of other countries.

When you have a single-member LLC and you don't elect any other tax status, such as an S Corp, then the LLC is what's called a “disregarded entity”. That means it changes nothing in terms of taxes: you have your LLC, but you act like it doesn't exist and you report your income and expenses on your Schedule C, just as if you didn't have the LLC.

So the question is, why should you create an LLC? Some people have it because operating through the LLC can allow you, for legal reasons, to limit your liability to only your business income. If there were ever any legal action, the idea is they couldn't go after your personal assets. I’m not an attorney so I can’t speak to the legal implications of that, however.

Another reason is that it can give your self-employment activity an air of professionalism. But from a tax perspective, a single-member LLC doesn’t change anything at all. You're still self-employed and you still report everything on Schedule C.

Do clients know to give you a 1099 or is it your responsibility to reach out and ask for it?

It's your client's responsibility to issue 1099s if they pay you more than $600. They can be subject to penalties if they don't. A lot of people don't know this, and file 1099s late or not at all.

Whether the client issues a 1099 is up to them, and the risk is only on them, but with that said, it's still your responsibility to report your income completely. That's why I suggest that people independently track their income. If you've been tracking your income properly, it shouldn't make a difference whether clients issue a 1099 or not. Of course, if you want to be nice to your client, you can ask them to send it to you, but the risk is not on you.

The way I think about it, I look at all the 1099s that I have received throughout the year, and then I make sure that I report at least that amount on my Schedule C. If I don't, the IRS is going to have questions. If I had additional income, that needs to be added as well. So that's why you can't be passive and wait for 1099s to come in.

Q: How do you keep track of your income and expenses as a freelancer?

Suggested answer

I use an excellent system for Australian freelancers called Rounded to track all my business-related finances. I also use it to keep track of my work hours. I used to use spreadsheets to track everything and was quite good at doing this but Rounded has made that part of my work so much easier and quicker, and I'm confident everything balances. My accountant can access it too, so it makes tax time a piece of cake.

Lauren is available to hire on Reedsy ⏺

I use Freshbooks to track every dollar in and out.

Tracy is available to hire on Reedsy ⏺

I’ve been using an agency software called MOCO (which includes time tracking and invoicing, among other things) for many years. I highly recommend it to both freelancers and design agencies.

Jonathan is available to hire on Reedsy ⏺

For more professional insight on topics like how to create a great freelancer profile, get more freelance clients, or notifications about events like this, subscribe to our Freelancer newsletter or follow us on LinkedIn.