Blog •

Last updated on Nov 07, 2023

How to Do Taxes as a Freelancer in 5 Essential Steps

This guide was created in consultation of tax professional, Grace Taylor. It is meant to be a starting point for informational purposes only, and should not be a substitute for professional tax, legal, or accounting advice. We strongly recommend you supplement your knowledge of U.S. taxes (or taxes in your country of residence) with your own research.

Freelancing offers a lot of freedom — it’s literally part of the word — but liberty comes at a cost. And in this case, the cost includes having to handle your own income and tax. Thanks to the US tax code, doing taxes as a freelancer can quickly get overwhelming if you don't get to grips with the basics.

But have no fear! In this post, we'll show you how to effortlessly manage your taxes as a freelancer in 5 steps. By the end, you’ll be ready to live the dream — worry-free.

1. Know when you have to pay taxes

Every individual must file their annual tax return on the 15th day of the fourth month after the end of that tax year. Since the year ends in December, that generally means that Tax Day is April 15th.

In 2022, the deadline has been shifted to April 18th for most states to avoid clashing with the Emancipation Day holiday in D.C. Read more here.

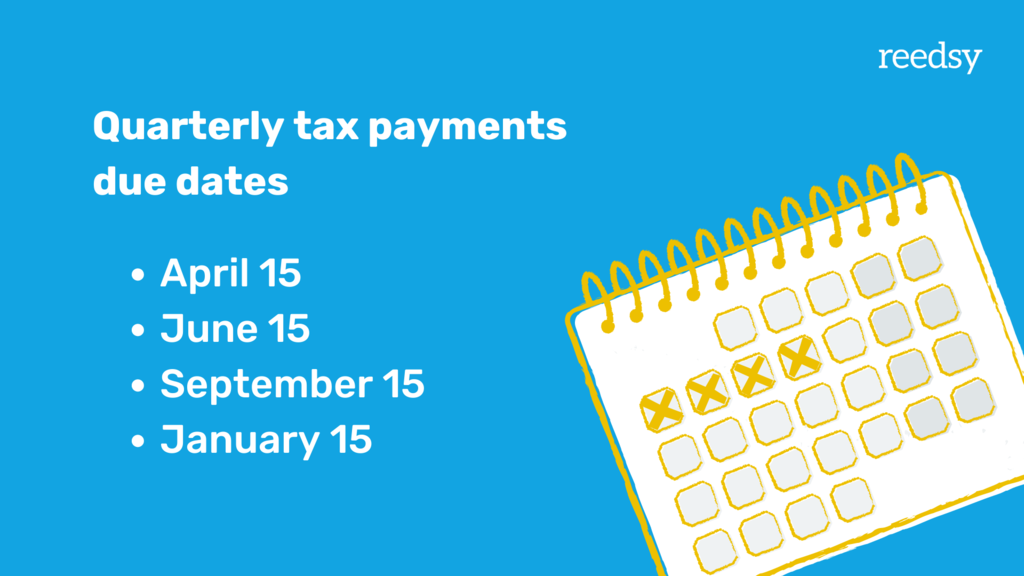

However, freelancers are a special case: to help you avoid the prospect of souring your spring and paying a large sum of money all at once in April, you’re asked to pay the estimated taxes you owe quarterly. Which means that your tax schedule as a freelancer is as follows:

- April 15: File your annual tax return for the previous year & make the first estimated quarterly payment for this year

- June 15: Second estimated quarterly payment due

- September 15: Third estimated quarterly payment due

- January 15: Fourth estimated quarterly payment due

If you underpay your quarterly taxes, you’ll simply owe the IRS the remaining balance when you file your annual tax return on April 15. (And if you overpay your tax, don’t worry! Once you file your annual tax return, you’ll get refunds for extra payments.) In other words, in April, you might have to make two payments: one to settle any remaining balance from the previous year, and one for the first quarter of the current year. These have to be made separately so that the record kept for each tax year is accurate.

Be aware also that you can (and should) get the documents and payment in before the cut-off day. Late payments are susceptible to penalties.

Tax preparation software like TurboTax, H&R Block, or Credit Karma (which is a free option!) will help put together a payment schedule for you so you don’t have to worry too much about it. Similarly, they’ll take care of some of the documentation, which will be covered next.

2. Gather the necessary documents

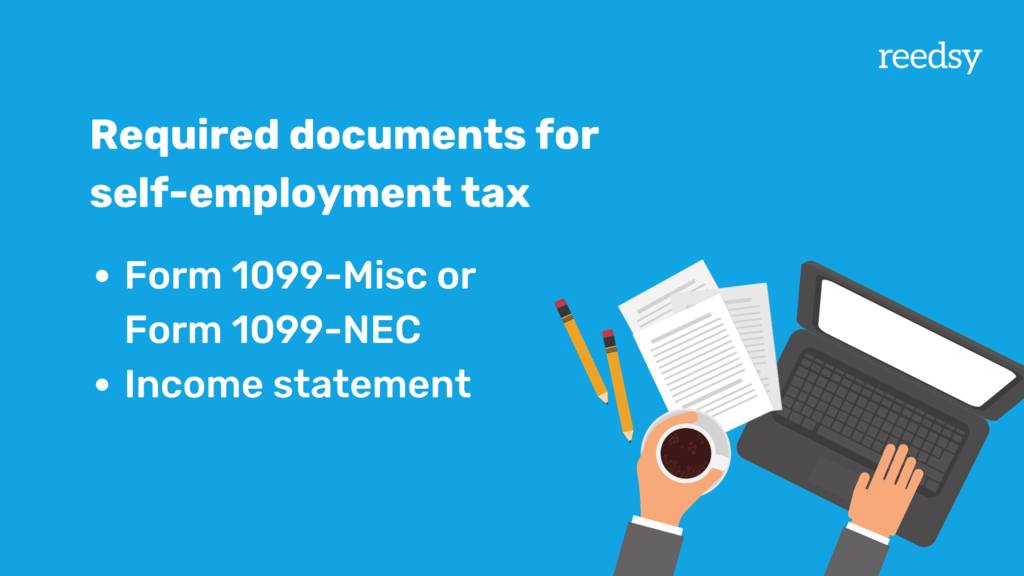

When you make your quarterly payments, and when you file your annual tax return, you will need certain documents:

- Form 1099-Misc (or the redesigned Form 1099-NEC), which is the self-employers' version of the W-2, declaring a source of income (only needed when the client is paying over $600); and

- An income statement to report the expenses and earnings of your business (handy for when filling in a Schedule C).

You can get the 1099s from your clients, while the income statement comes from your own accounting. If you’re using a tax preparation software, like the ones we mentioned above, it will oftentimes automatically fill out a Schedule C for you.

These are to be sent to the IRS along with your payments, so that they can verify that you’ve accounted for relevant transactions. Note that you might not have a 1099 form for every single payment you receive (because some are lower than $600), but all your freelance income, no matter the amount, has to be reported on your income statement.

Here’s a pro-tip: update the financial record of your freelance business daily. Whenever you spend something or receive something related to your professional activities, track it in a Microsoft Excel sheet. This way, by the end of the quarter, you won’t have to scramble for some receipt or invoice from three months ago, trying to figure things out. It takes a tiny bit of time everyday, but it’ll soon become so natural you won’t even think about it! And keeping track like this will make doing taxes that much less painful.

If you’d prefer not having to build your track sheet from scratch, we recommend checking out platforms like Quickbook, FreeAgent, and Freshbooks. For freelancers newer to the trade, more intensive apps like Bonsai (which even provides invoice templates for billing clients on top of tracking and calculating taxes) is a good option.

FREE RESOURCE

Invoice Template

Provide billing and payment details with this professional template.

And now we’ve got the technicalities down, it’s time to focus on the most important part of doing your freelancer tax: knowing your deductibles and calculating the tax payments!

3. Figure out your taxable income

First up: know your gross income, or the total amount that your employer paid you before taxes or other deductions.

Then we go from there to calculate your taxable income. As you may know, you don’t owe taxes on every penny you get paid. Generally, there are deductions that everyone is entitled to, and freelancers get extra deductions as people who technically run their own businesses. Some of the expenses that can be deducted from a freelancer’s income include:

- A portion of rent if you work from home (calculated based on the square footage of your workspace)

- A portion of internet and utilities

- The cost of visiting a freelance work hub or hangout

- Health insurance premiums

- Contributions to your retirement fund

- Phone call costs or Skype credits

- Software packages (Microsoft Office, Adobe Suites, etc.)

- Payment management system fees (Stripe, Paypal, etc.)

- Professional memberships (EFA, ACES, Linkedin Premium, etc.)

- Printers, paper, and ink (plus your scary red editing pen)

- Computer, laptop, or tablet (or the equivalent percentage of time you use it for work)

- The freelancer commission fee

- And an accountant… though hopefully you’ll no longer need one!

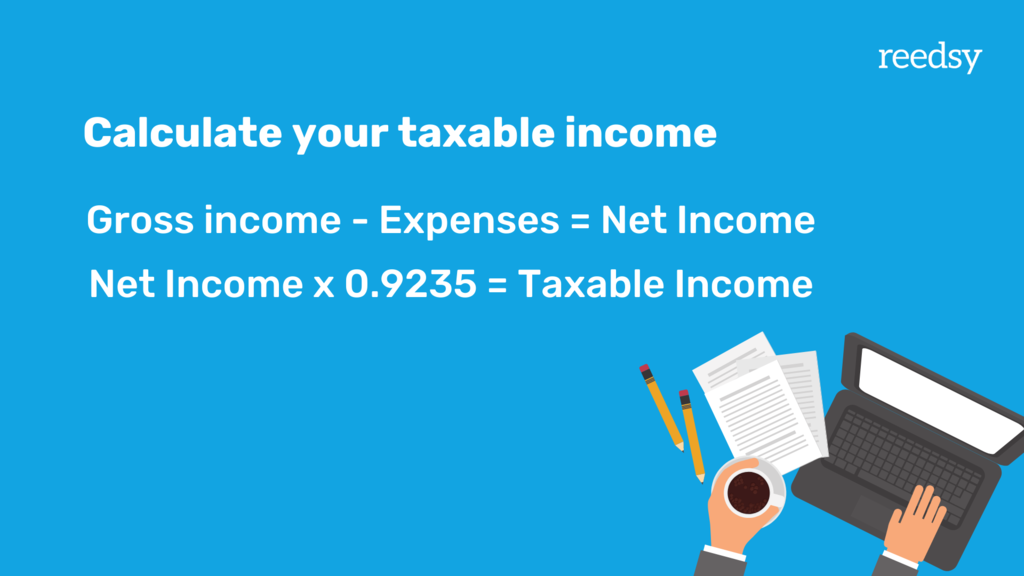

Once you’ve deducted all these costs from your gross income, you get your net income. If this amount exceeds $400, you are expected to pay self-employment tax. (Keep in mind that on top of this, you will also have to pay federal income tax and state taxes, depending on where you live.)

But wait — the net income still isn’t your taxable income. Keep in mind that employment tax is essentially contributions that workers and employers make to the US Social Security and Medicare system, so that workers can benefit from their services. Usually, W-2 employees and their employers would make equal contributions to this tax via payroll withholding.

As self-employed workers, freelancers are responsible for both portions, though it is a bit unfair because there aren’t two separate entities to share the burden. To address this, the taxable income is limited to 92.35% of your net income.

Sounds like a bit of a maze? Maybe this example from our hypothetical fellow freelancer, Jay, might help:

Jay earned $55,000 of gross income through freelance editing this year — and his deductible expenses (including the price of Microsoft Office subscriptions and a proportion of the rent and bills) totalled up to $13,000.

His net income is then $42,000, and his taxable income is:

$42,000 x 0.9235 = $38,787

FIND CLIENTS

Grow your business on Reedsy

Submit your application to join our curated network and connect with clients.

4. Calculate your taxes

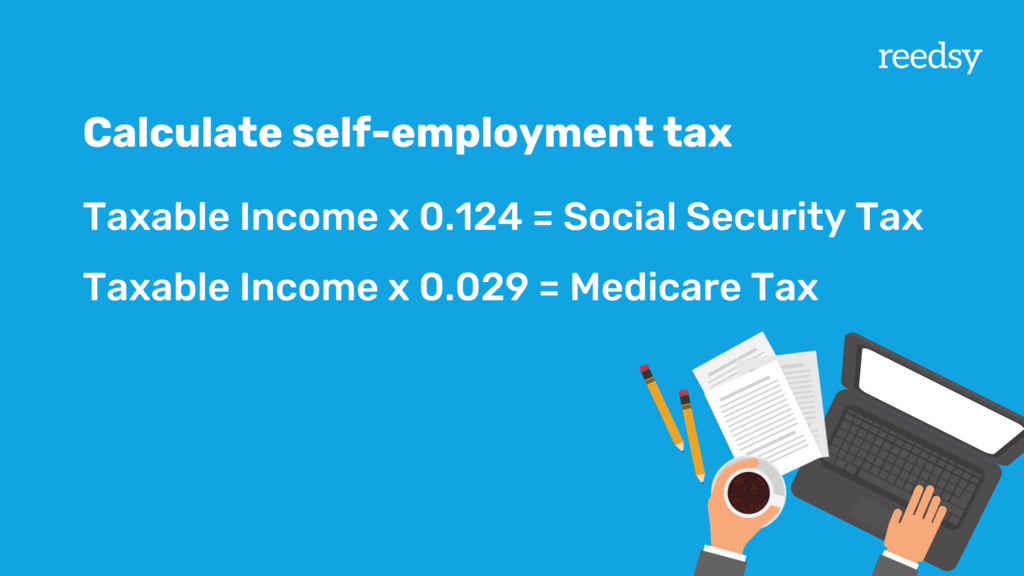

Now, let’s calculate your actual taxes. For freelancers, your taxes will look like this:

Self-employment taxes = Social Security tax + Medicare tax

We’ll dive into exactly what each part of this equation means shortly. But if you want to skip the explanation and get a straight-up estimate of your taxes, we recommend turning to one of these several handy tax calculators:

Of course, you can also hire an accountant who can help you handle all of this. And we wouldn’t blame you: trying to understand things like global payroll tax compliance can cause real migraines!

Now, if you want to understand the rationale behind these calculations and understand why you pay what you pay, here’s a breakdown of these taxes.

Social Security tax

The flat rate for the social security tax is 12.4% of your net income if it’s below $142,800 per year (beginning from 2021). Beyond this level of income, you don’t have to pay this portion anymore.

Jay, our friend, will have to pay this much Social Security tax:

$38,787 x 0.124 = $4,809.59

Medicare tax

For Medicare tax, the rate is 2.9% for self-employed individuals. If your net income is above $200,000, you’ll pay 2.9% for the first $200,000 and then 0.9% for the rest as an Additional Medicare tax.

In Jay’s case, his Medicare tax will be:

$38,787 x 0.029 = $1,124.82

Putting it all together

Combining the two fees, you get the full tax payment you’re responsible for paying. When you earn less than $200,000 per annum, the total self-employment tax rate is 15.3%.

Combining both elements, we have Jay’s self-employment tax:

$4,809.59 + $1,124.82 = $5,934.41

5. Send in your forms

Congratulations on getting to this step! Now all you have to do is fill out your forms and remember to send them off to the IRS before the due dates. Here’s a list of to-dos for you when this moment comes:

- Collect all your 1099 forms

- Fill out your Schedule C to report your income or loss (the instructions to which are here, if you need them)

If you’re paying by check, you’ll have to submit a Form 1040-ES also (this form essentially outlines your payment schedule). But if you’re using a tax preparation software and are paying via bank transfer, then you don’t have to worry about the 1040s. A software will also automatically fill your Schedule C once you provide your income statement.

Once your documents are submitted, head on over to the IRS’s payment portal to pay directly from your bank account or debit/credit card — and voilà, you’re done! And with that, our guide on how to do taxes as a freelancer is complete. Best of luck, and we hope that you can now tackle your forms with more confidence.

On the freelancer blog, you can learn more about money managing for self-employement in the US and across the pond.