Blog •

Posted on Mar 31, 2023

Live Chat: Managing Your Finances and UK Freelancer Taxes

About the author

Reedsy's editorial team is a diverse group of industry experts devoted to helping authors write and publish beautiful books.

More about the Reedsy Editorial Team →Linnea Gradin

The editor-in-chief of the Reedsy Freelancer blog, Linnea is a writer and marketer with a degree from the University of Cambridge. Her focus is to provide aspiring editors and book designers with the resources to further their careers.

View profile →Below is the transcript from our live chat on March 28th, 2023, where Anita Forrest — chartered accountant and founder of goselfemployed.co — elaborates on the foundations of self-employed finances and taxes in the UK.

🌍💸 Many of the principles discussed in this webinar will apply beyond the UK, but you can also check out our post on finances for freelancers 101 and our post on how to do your freelance taxes (in the US) for more information. This is for informational purposes only, so remember to seek out specific advice for your case from a licensed tax advisor.

This transcript has been edited for length and clarity.

Skip to 4:12 for the start of the presentation.

Anita: Today I’ll give a roadmap of how taxes work for freelancers in the UK. We’ll look at sole trader taxes, what's expected of you, some key concepts and tax terms, and what you need to tell HMRC. I know that the HMRC website can be confusing, which is partly why I started creating content: to try to clarify what's expected when someone registers as self-employed.

👑HMRC stands for His Majesty’s Revenue & Customs, which is the department of the UK government responsible for tax collection and the payment of certain forms of state support.

I don’t know if people are planning to DIY their taxes or use an accountant, but either way, it's really helpful to go through the basics of what self-employment tax and things like VAT mean because, as a business owner, it's your responsibility to know these things and to know what you are affected by. Unfortunately, HMRC isn’t going to tell you. You have to work it out yourself. And if you're going to run your own business or work for yourself, you should know what might impact you now and in the future.

Being self-employed

Self-employment means that you work for yourself, rather than someone else. You're responsible for finding your own work, you can turn it down if you want to, or you can outsource it and get someone else to deliver it. It's really unlike when you work for someone else who decides your schedule and work tasks.

People use different terms: often, creatives might call themselves freelancers, while others will call themselves self-employed or sole traders — but when it comes to tax, it all means the same thing and you’ll be following the same rules.

FIND CLIENTS

Grow your business on Reedsy

Submit your application to join our curated network and connect with clients.

You are responsible for your own taxes

If you’ve ever received a payslip, you know that there are lines for tax being deducted, national insurance, your pension, and other adjustments that your employers are taking care of before they pay you. They report back to HMRC and pay the tax that they’ve taken out of your payslip on your behalf. But when you’re self-employed, it's down to you to handle your own taxes. You’re getting paid money that has not had tax deducted and, in most cases, all income that freelancers receive is taxable, with the exception of a few things, like state benefits. The money is just sent to your bank and no one is looking at how much you’re earning.

There are no tax codes in place to help you deal with that, and it's up to you to report your income to HMRC, using their system — which is called self-assessment (which we'll look at later) and pay the tax that you owe.

It's important to remember that when that money hits your bank account, there's no tax deducted. It might be exciting to see £1,000 hit your account, but if you owe 20% tax, you're going to be paying £200 to HMRC. So, always remember that it's your responsibility to sort your own taxes out.

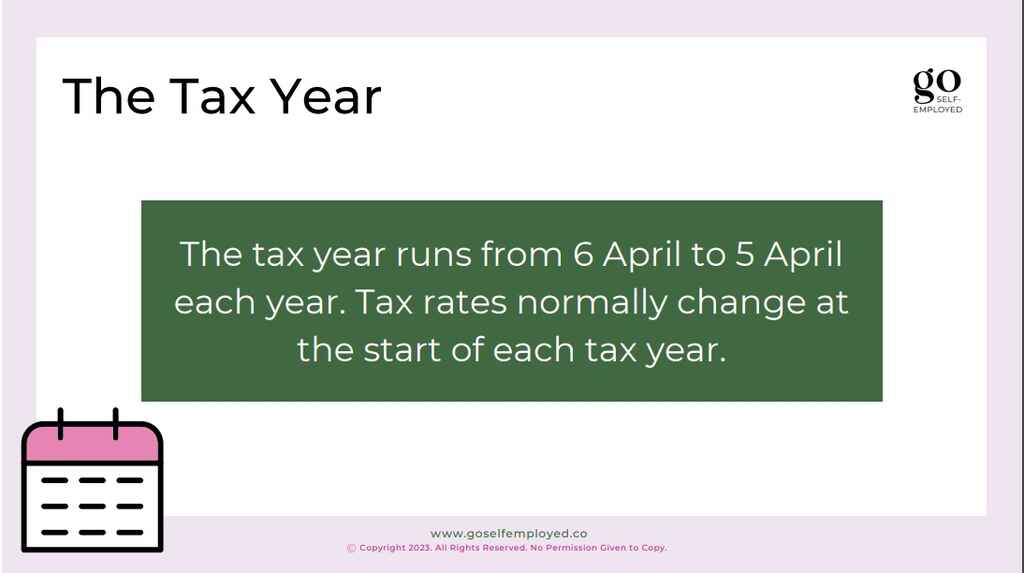

The UK tax year

Now, before we look at anything else, let’s define the tax year:

⚠️ The tax year is different in every country, and in the UK it runs from the 6th of April to the 5th of April each year.

If you’re working for yourself, this is an important deadline, because the tax rates change for every tax year and you might want to use up your tax allowances before it does.

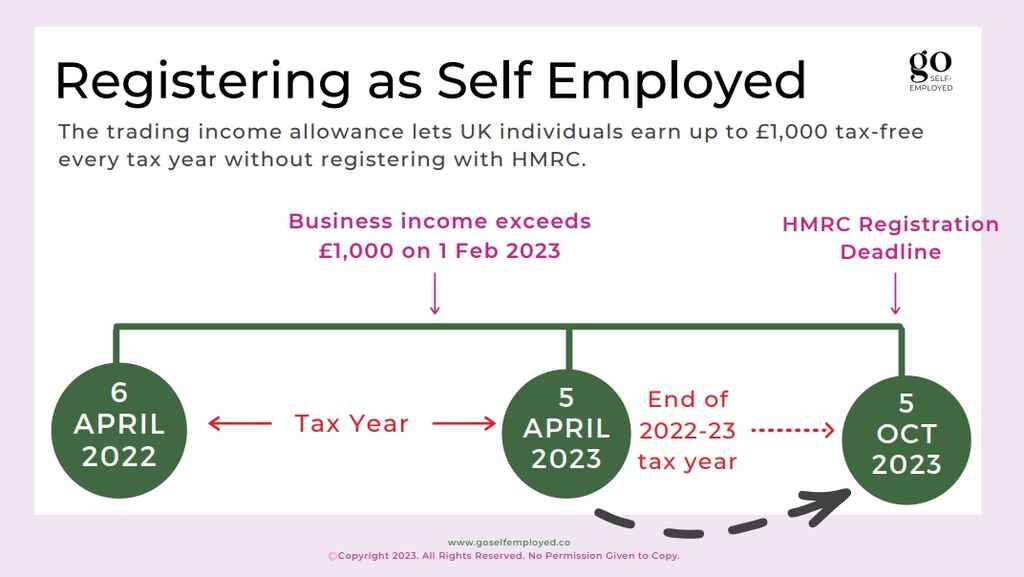

Registering as self-employed

In the UK, you also have to register as self-employed, and the deadline to do so is on the 5th of October, following the end of the tax year. That means that if you started working for yourself today — the 28th of March — you would need to register by the 5th of October this year. That's because the tax year is ending in a few days, on the 5th of April.

Trading allowance

One of the income allowances that you can get as a freelancer is the £1,000 hatchery trading allowance. That lets everybody in the UK earn up to £1,000/year as self-employed, tax free. If you earn below this amount, you don’t have to register or let the HMRC know about your earnings.

This means you can dip your toe into freelancing if you want to see how you feel about it, without paying tax. Originally, this allowance was designed for people like babysitters and online hobby vendors who didn’t really want to go through a process of registering as self-employed because it’s just too much work to be worth it. Now, it's extended to include freelancers, so if you are under £1,000 in freelance earnings, you don't need to do anything.

💡Top tip: If you want to try freelancing but aren’t sure if you’ll like it or be able to make ends meet, you can dip your toes and earn your first £1,000 without paying taxes.

It's worth checking where you are in terms of that allowance, because you could avoid your registration for a little bit longer. And it's tax free, so if you split your earnings across two tax years, you could potentially earn up to £1,000 pounds in the next year as well.

The registration process

To register as self-employed, you need to go to the HMRC website and submit a form where you put in information about yourself, including your national insurance number, and your freelance activities. They'll send you a unique taxpayer reference number (UTR). That tells you that your registration is complete and that you’re officially self-employed.

They will also send you an activation code to complete setting up your personal tax account. The code expires after 30 days, so don’t forget to enter it into the system. I have spoken to people who have let it expire and couldn't fill in their tax return. They missed their deadlines and got hit by a fine just because they didn't put the code in. So please, as soon as you get it, make sure you put that code in.

⚠️Remember to activate your account immediately after you receive the code to avoid fines.

There’s a guide on my website for how to register where I walk you through how to complete it. It's very straightforward.

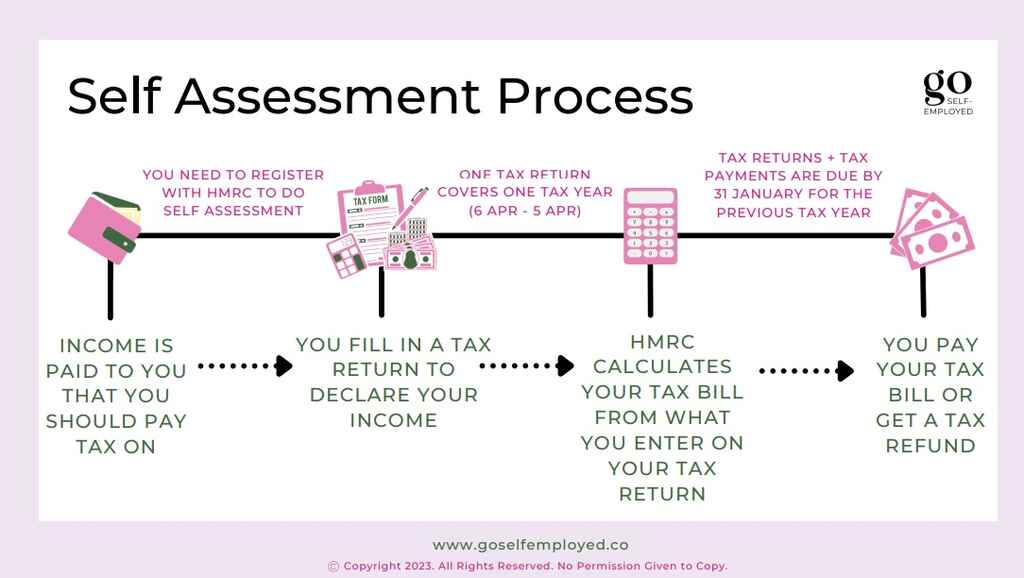

Doing your self-assessment

Once you're registered, there's a process to let HMRC know the income and expenses that you've incurred throughout the tax year, as well as fill in a tax return and pay the taxes that you owe. That's called self-assessment.

Tax return

The tax return is a form that you find once you've set up your HMRC account. It's made up of loads of different sections. You don't have to fill in all of them, but you do have to fill in the first section, which is just a little bit about your name, address, things you might want to claim, whether you've received dividend income, pension, and so on. There will also be a box to say that you are self-employed. That generates another section where you can fill in your self-employment income and expenses.

🏢 If you own shares in a company which is making profit, you can earn dividend income. Read more about how it works in conjunction with tax here.

It's a big form and quite daunting, but actually, once you get into it, it's not that bad. And once you've completed one, you'll find there are a lot of boxes that many people who have very simple tax affairs don’t have to fill out, so you can do it quite quickly.

One tax return covers one tax year. That's why it's important to remember the tax year dates: 6th of April to the 5th of April. And in that form, you're going to tell HMRC about all your income that you've earned in that tax year. You've got 10 months to file it — that's the 31st of January each year — and what you filed on the 31st of January 2023 would relate to the previous tax year, which ended on the 5th of April, 2022. That 10 month lag gives you a bit of time to do it slowly — or leave it to the last minute, as some people do.

Once you’ve submitted your tax return, HMRC calculates your tax bill based on what you've entered. You don't actually need to do anything else but pay.

That’s self-assessment in a nutshell. It’s really just a process of giving people a way to declare what they've earned and pay that tax. But, always remember that the money you initially receive has no tax deductions. So you need a way to make sure you're putting that tax money aside and have the funds to pay it, once the tax bill arrives.

Tax rates

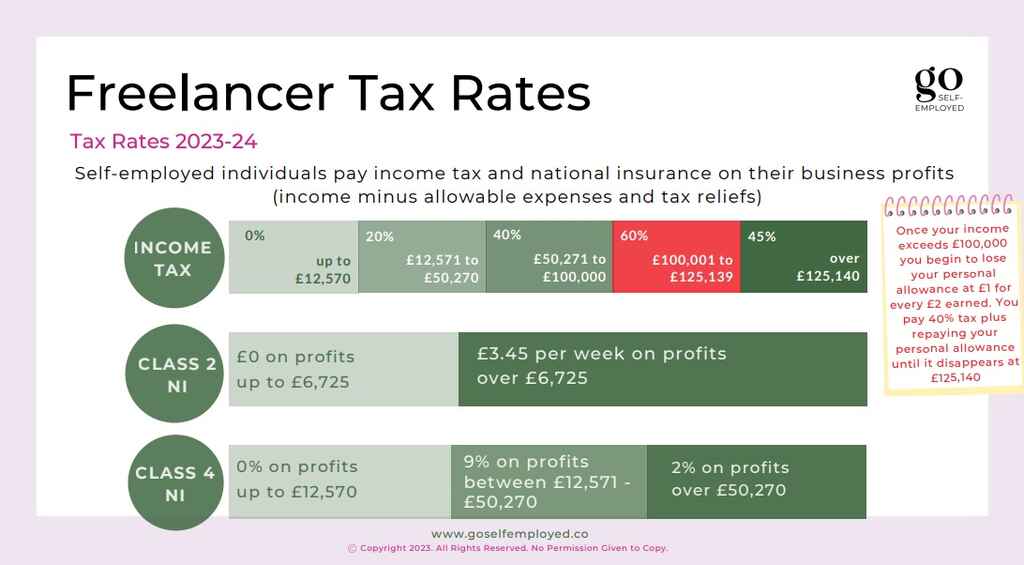

As self-employed in the UK, you pay income tax, Class 2 national insurance, and Class 4 national insurance. The amount you pay depends on how much you earn.

There's a sliding scale for profits — that is, your income minus your business expenses — so let's assume you earned £10,000 as a freelancer, but you had costs of £2,000. You'll pay income tax and national insurance on the remaining £8,000. HMRC will calculate that for you and issue a breakdown of how they've calculated it, so you can check and go back to them with any queries you might have.

The amount you pay is, again, dependent on what you earn, and there are tax-free thresholds for each category (income tax, Class 2, and Class 4 national insurance). Those are the amounts you can earn before you start owing taxes to HMRC:

|

Income tax |

Class 2 NI |

Class 4 NI |

|

Up to £12,570, plus the £1,000 trading allowance |

Up to £6,752 |

Up to £12,570 |

Class 2 covers your state benefits like maternity pay, or allowance if you’re self-employed and Class 4 is really just a freelancer tax, equivalent to Class 1 if you were on a payslip.

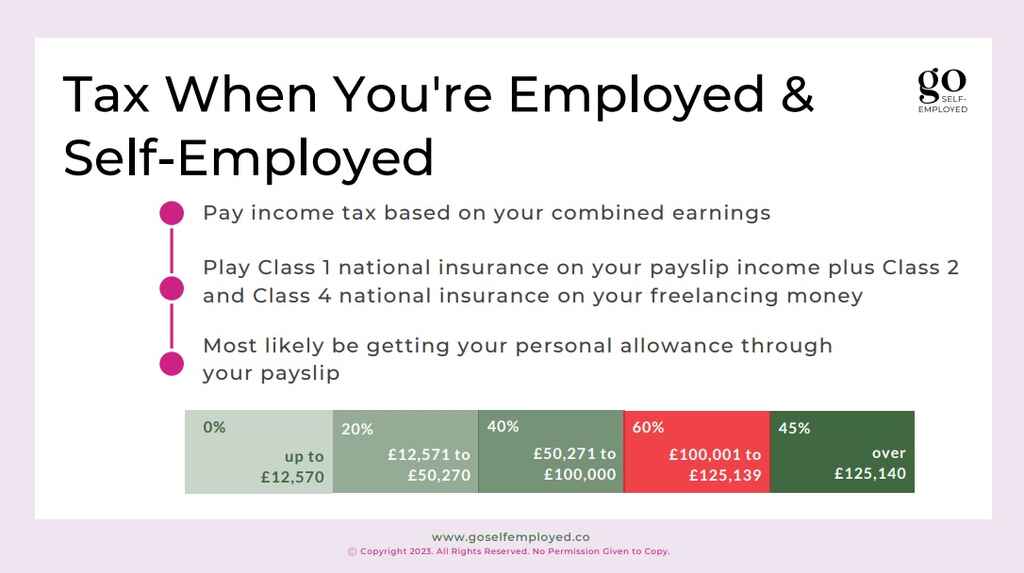

When you’re both employed and self-employed

If you're both employed and self-employed — which a lot of people are — you will pay three types of national insurance: Class 1 through your payslip, Class 2, and Class 4. You’ll pay income tax based on your combined earnings, so say you earn £30,000 in your job and have a profit of £30,000 from freelancing. However you work that out, you'll pay income tax on £60,000.

Now, you don't pay 40% on all of that. It’s a sliding scale, so you’ll only pay 40% on the portion that falls into that band. The first £12,570 you earn (your personal allowance) is free, the next range is 20%, and the final band you will be affected by is 40%, which you will pay on anything you earn above £50,270.

You’ll most likely receive your personal allowance through your payslip, but you might want to double check to make sure you’re not receiving it twice, from both your employed and self-employed earnings. Otherwise you might be surprised when it comes to your tax return.

🤑 If you’re splitting your time between employment and freelancing, make sure you’re not receiving your personal allowance twice, or you’ll be surprised by your tax bill.

Important tax terms

There are lots of terms related to taxes which are important to be aware of, especially as you venture into self-employment.

Let’s look at a few.

Cash basis

Besides the tax year, which we’ve already spoken of (remember, 6th of April to 5th of April), “cash basis” is one I always get questions about. People aren’t sure what it means when they see it on their tax account, but it simply means that you declare your income on your tax return according to the dates that the money comes in and out of your bank account.

That's useful if you invoice clients and give them, for example, 30 days payment terms, you don't need to register or pay tax until the money is in your account, and if that occurs after the end of the tax year, you can push back and hold onto your tax money for a bit longer.

🦜Through Reedsy, you’ll receive your payments via Stripe, directly into your account, so if you operate on cash basis, you can bookkeep and declare your income as soon as the money is in your vaults.

Cash basis helps simplify your bookkeeping because you can just pick the figures straight from your bank statements.

FREE RESOURCE

Invoice Template

Provide billing and payment details with this professional template.

Payment on account

This is an important one.

You need to make a tax payment on the 31st of January — 10 months after you’ve filled in your tax return — but, in most cases, you'll also need to make an advanced payment (50% of what you’ve paid) towards next year's tax bill. So, if you’ve filed a tax return on the 31st of January and your tax bill was £10,000, you'll need to pay an extra £5,000 in advance, towards your tax return on 31st of January, 2024. You'll also need to pay another £5,000 pounds on the 31st of July.

You'll get credit once you file your taxes on the 31st of January, 2024 that you can then use for your next payment on account, but you're going to need to make that advanced payment. Given that you've had 10 months to clear between the end of the tax year and filing your return, you should have the money in your account to make that advanced payment. But it does sting a lot of people — especially in their first year — because they're getting no credit for previous taxes and they're simply paying an extra £5,000 towards their next tax bill. So, you really need to be mindful of that.

💰Remember to set some tax money aside every month based on what you’ve invoiced and your estimated tax rates, in preparation of your tax return and advanced payment on account.

Allowable and disallowable expenses

When it comes to buying things as a freelancer and calculating your profits (your earnings minus any expenses you’ve had related to running your business) you’ll want to know whether an expense is allowable or disallowable.

Allowable expenses are things you can claim tax relief on. If you have £10,000 in income and £2,000 in costs, you can generally deduct those £2,000 before you start working out your tax bill. But there are some expenses that you can't claim tax relief on, even though they were potentially in line with your business. We'll talk about that in a bit.

But first, let’s look at what you are allowed to deduct.

Tax allowances

Tax allowances can help reduce your tax bill. In reality, however, there's not a huge amount of clever things that freelancers can do. But one of the main allowances is the personal allowance (the amount you can earn tax free) as well as the trading income allowance of £1,000. Then there’s your ISA allowance, which is tax-free savings in ISA accounts, and your pension, which reduces your tax bill by your contribution, up to £40,000. Next year, they’re increasing that to £60,000.

ISA = Individual Savings Accounts. When you put your money in an ISA it grows free of income and capital gains tax, and can be withdrawn without any tax charges.

There are different types of ISA accounts and you can save up to £20,000 in one type of account or split the allowance across some or all of them, but you can only pay £4,000 into your Lifetime ISA in a tax year.

Read more about how ISAs work here.

There's also the marriage allowance, which means that if you or your partner are both in the 20% tax band, you can transfer any unused personal allowance between you up to 10%, or £1,260. At 20%, that's worth £252. So, if one of you is not working or perhaps work was quiet and you didn't use up your personal allowance, you could always pass that over to your partner. It’s a little something that not a lot of people know about, but it’s a really good one for another £250 in your pocket. You can also go back several years to claim it, so it's worth checking if you hadn't used it up.

Personal vs business expenses

As for expenses that you can claim, us freelancers often have our laptops and maybe some subscriptions, but other than that, minimal expenses. You might find that your tax bills feel high, but because you don't have anything to deduct, it is what it is.

A lot of people will talk about how they deduct all sorts of things against their tax returns, but chances are they're probably not supposed to. When it comes to claiming expenses, they need to be wholly and exclusively related to your business. So your laptop and subscriptions are clearly related to your business, as are bank charges on your business account, for instance. As long as you are sure that they're clearly related, you'll be able to deduct them.

So what about things that you can't deduct?

Well, for instance, you can’t deduct fines and penalties from HMRC. It's all part of the punishment. The same goes for parking tickets, even if you got it because you were out on business.

Your salary is another big one. Even if you earn a certain amount and you decide to pay yourself a fixed salary each month you're just taxed on your earnings regardless of your salary. It doesn't matter what you do with those earnings and how you spend them: it all remains taxable.

Q: How do you keep track of your income and expenses as a freelancer?

Suggested answer

I use an excellent system for Australian freelancers called Rounded to track all my business-related finances. I also use it to keep track of my work hours. I used to use spreadsheets to track everything and was quite good at doing this but Rounded has made that part of my work so much easier and quicker, and I'm confident everything balances. My accountant can access it too, so it makes tax time a piece of cake.

Lauren is available to hire on Reedsy ⏺

I use Freshbooks to track every dollar in and out.

Tracy is available to hire on Reedsy ⏺

I’ve been using an agency software called MOCO (which includes time tracking and invoicing, among other things) for many years. I highly recommend it to both freelancers and design agencies.

Jonathan is available to hire on Reedsy ⏺

Working from home

When it comes to working from home, you have two choices: you can use what's called simplified expenses, where you claim a flat rate for your electricity and other bills; or you can work out a portion of the expenses that are incidental to being in your house.

The simplified method is £10/month if you work between 25–50 hours/month. Then it goes up to £26 maximum if you work 101 hours/month or more. It isn't a lot, especially in regards to energy bills, but you don't have to keep receipts and you don't have to work anything out, so it’s quite a lot easier than if you’re claiming a portion of your bills. If you do that, you're going to have to keep your bills, show how you've worked it out, and crucially, if you own your own home or if you rent, you could end up with a rates bill because you've declared that part of your home is an office. So you need to be quite careful which one you choose. That's why a lot of people just end up doing the simplified method and claim a flat rate. It's not super generous, but at the end of the day, if your job is remote, unfortunately that's the cross your bear.

If this sounds like something for you, check out remote proofreading jobs here.

Claim within reason

For your business expenses, you can claim as frequently as you like. It's just that if you're buying three laptops, it's going to look slightly suspicious — like maybe you bought that for someone else in your family — so you need to make sure you can evidence that it is 100% for your business.

To prove it, you talk to HMRC and let them be convinced. They’re really nice people, but they know how to smell a rat. There’s a level of reasonableness that you need to bear in mind. Some people need three laptops, so that’s fine, but don't get too carried away. Keep your head above water and do it properly.

Doing your bookkeeping

As a freelancer, you need a way to track your income and expenses. Failing to track expenses correctly is actually one of the biggest ways people lose tax relief. They lose receipts and invoices, or they're rushed at the end of the tax year and decide to just forget it.

Opening a separate bank account

The first thing to do is to open a separate bank account. I would definitely recommend it because if you divert all your payments, receipts, and income into one place, it means that you have everything in one place, even if you don’t do anything. Then, you can always grab those statements and know how much you’ve made in profit. It makes life a lot easier. You can forget about it and make payments as you’re out and about and know that you’ll be able to keep track of it and get your tax relief.

Alternatively, if you have stuff running through your personal bank account, you have to sift through and work out which payment is coming from where. If it's on your personal account, and you decide to “forget about it” and you do that 10 times, you’re losing out.

So, opening a separate bank account definitely makes things easier. You might not even do any bookkeeping until the end of the year, but you could refer to those bank statements and match it with your receipts to know everything you need for your tax return.

Spreadsheet vs bookkeeping software

Bookkeeping is the recording of income and expenses and storing of supporting records. In order to meet your legal obligations, you must keep track of deductions, prepare your accounts, and fill in your tax returns. The question is how to keep track of the things coming in and out.

It is a legal duty to keep accounts for your business, as well as an EU and HMRC requirement to keep all your bookkeeping records for inspection for a minimum of 6 years, whether or not you’ve ceased trading.

First, make sure you've got your receipts and numbers ready for your tax returns so it all goes smoothly and you're not left trying to remember when you did everything last minute. The two main ways you can do that is to use a spreadsheet or accounting software.

Spreadsheets don’t require a monthly subscription and are really good for simple accounts. I sell one on my website, and it's a good way of getting started with bookkeeping because you start to understand income, expenses, and exactly what's required of you in the first tax year.

With accounting software, like Xero or QuickBooks, you’ll have a monthly cost (which is tax deductible), but if you have lots of transactions and invoices to send, you can link your bank accounts and pull those transactions automatically. Not typing them out manually as you would with a spreadsheet can save you a lot of time. It also remembers where things might go and is a bit smart, so it can help you with numbers and record-keeping. And if you invoice clients regularly, you can send your invoices through the system and get them logged. If they’re overdue, you can send out reminders straight from the software and offer your clients different payment options. So, depending on your client base, software can be very, very helpful.

Certainly, if you’re invoicing abroad and in different currencies, software like Xero and QuickBooks have functionality for foreign exchange. You can send out foreign currency invoices and it works out the exchange rate for you, which makes life a lot easier. But it isn't necessarily useful if you're a small business owner with very simple ins and outs.

Registering for VAT

VAT (Value Added Tax) is something that, as a freelancer, may never apply to you, depending on how much you earn. But, it’s still something you should be aware of.

We all pay VAT on goods and services that we buy in the shops. It’s a levy on what’s perceived as luxury items, and depending on what you’re buying, you’ll be paying a different rate (usually 20%). Basically, VAT is a tax on consumers and non-VAT registered businesses.

The government collects VAT by making businesses that have a turnover of over £85,000 become VAT registered. If you’re VAT registered, you have to charge VAT on everything you sell and you can claim back the VAT on everything you buy.

So, once your turnover starts approaching £85,000, you'll need to consider whether you should register and charge your clients 20% more, on top of your invoice fee. If you are invoicing other VAT-registered companies, that's fine. They'll claim it back and it’s irrelevant. But if you’re billing individual customers, then you have to consider how adding 20% will affect your price. Individuals can’t claim VAT back, so you could potentially end up pricing yourself out of the market.

👆 You can read about how Reedsy handles VAT here.

If you're not VAT registered, when you fill in your tax return, you fill it in with the VAT-inclusive price because you can't claim it back. If you are registered, you’ll need to submit VAT returns, which is a whole set of other paperwork which adds a separate bit of admin.

Hiring an accountant

Whether you should or shouldn’t hire an accountant is always a bone of contention. There's no legal requirement for you to use an accountant and even if you do, it’s still ultimately your responsibility to get the tax return in on time and filed correctly, legally speaking. So you must know your obligations.

⚖️ Remember that you’re ultimately responsible that your tax is filed correctly in front of the law. That’s why you’ll sometimes see celebrities and sports stars — who probably don’t manage their own finances — get into financial pickles. So, even if you hire an accountant, it’s important to be familiar with what is required of you and how things work.

If you don't feel very confident or can't be bothered to deal with numbers and learn how to use accounting software, hiring an accountant might relieve you of that burden — especially if you have complicated tax affairs and need some advice on how to handle that. It'll give you peace of mind that you've got an accountant who's dealing with your allowances and reliefs on your behalf and making sure you get everything that you are entitled to, and that you’re paying the right amount and don't get hit by fines.

It's also a professional onsite to help you if you get investigated. They’ll have put the numbers together and run through everything with you, so if HMRC ever looks into your accounts, you have someone to deal with that for you.

The cons of hiring an accountant are the cost and finding a good one. But if you’re happy to take the cost (which is a deductible expense) — which a lot of people are — you can get your tax return done for £150 or £200.

To find a good accountant, you could ask someone you trust, and speak to at least three different candidates before you make a decision. You can go on platforms like Fiverr, but check their reviews! Most of all, make sure you’re comfortable with them — they’ll be looking at your personal things — and can ask silly questions without them being arrogant or unapproachable.

Q&A session

What is a chartered accountant?

There are different types of qualifications. Chartered accountants are certified accountants and bookkeepers. There's a bit of snobbery attached to it. The perception is that chartered accountants are the top ones. In reality, it comes down to experience. You want someone to be qualified because they've gone through a certain process to get to where they are, but you also want to know that they have a certain amount of experience.

Do I need a specialist business bank account, or can I use a separate, personal account?

Technically, as a sole trader, you do not need a business bank account. You don’t even need a separate personal bank account, but it's something that I recommend because you’ll have everything in one place.

The banks don't like to know you’re using your personal bank account for business reasons, however. Business bank accounts have a higher fee and bank charges, and they want to make money. Personal accounts are free and you get your cashback deals, etc., so the banks will tell you that you can’t use a personal account. They'll want you to open a business account and if they catch wind, they might lump you with historic charges.

Can I deduct hotel costs if I outline how it was necessary for work and meetings?

Yes. As long as it's a one-off journey. If you have a regular client and start staying two nights per week somewhere on an ongoing basis, then that starts to fall into a gray area. But if it's a one-off, you can definitely deduct the expense. And you can claim a reasonable meal and travel expenses too. Just make sure you don't get carried away. One glass of wine, maybe.

I heard a rumor about paying your taxes in two installments, is that true?

We already pay our taxes in two installments: in January and June. Perhaps the rumor that you’ve heard is that we’re moving towards quarterly installments, but they backtracked on that about a month ago. It will only apply to people who earn over £50,000 and won’t take effect in a couple of years.

What happens with the payment on account if you’ve had an unusually good year?

You can apply to have it reduced. There's a form to reduce your payments on account where you can explain why. If, retrospectively, it ends up that you were just trying to reduce your payment and your income was actually really high, they might hit you with late payment charges though, so make sure that you legitimately need the reduction.

How does paying tax twice a year work with the personal allowance?

If you're self-employed and you earn £30,000 per year, the personal allowance comes off the £30,000 and you pay it after the tax year is over. So it doesn’t matter when or where the earnings are coming from. Your estimated tax burden for the next year will be estimated with the personal allowance factored in and is based on what you will actually need to pay to the HMRC.

So, the personal allowance is applied at the end.

Do you register with HMRC once or do you have to do it each year?

Once. Otherwise HMRC will expect several tax returns because you’ll set up a new UTR number each time.

If you do sole trading for a couple of years and then get a full-time job and want to pause your freelancing, you need to unregister. Every year that you’re registered, they’ll expect a tax return under the same UTR number. That’s like your national insurance number, or your code in the tax system. When you stop, you’ll unregister and they’ll close the UTR number. If, a few years later, you go back to being self-employed, you'll register again and get a new UTR number.

FREE RESOURCE

The Full-Time Freelancer's Checklist

Get our guide to financial and logistical planning. Then, claim your independence.

I registered as self-employed on October 5th, 2022. Am I only paying tax until April 5th, 2023?

Yes, that’s correct. You're going to do a short year on your tax return, and then you’ll start a full 12-month tax year on April 6th, 2023.

What entertainment expenses are allowable — e.g. internet, books, newspapers, and movies — assuming you work in the arts?

If you work from home, you could claim a portion of your broadband. For books, newspapers, movies, etc., you would need to show that those are completely related to your business.

It will depend on the field you’re in. As an accountant, for instance, I can’t claim going to the movies is related to my business. But perhaps you could claim that it was part of your learning if you were an actor. So if you’re a writer or editor, books might be reasonable, if you can present them as part of your learning and work. There’s no magic formula and it’s different case-by-case. Just think about whether it’s truly work-related. If there are any gray areas, it’s unlikely that you’ll be able to claim it.

Martin: I don’t think we have any more questions. Before we go, if people want to get in touch, where can they find you, Anita?

Anita: You can find me on Instagram and my website, where you can find lots of free guides on different self-employment topics, answering questions about limited companies, allowable expenses, travel expenses, tax terms, and so on. I also have a bookkeeping spreadsheet that is refreshed for the new tax year, and courses coming up, so if you want to deep dive into taxes and bookkeeping, you can find lots more there.

Martin: Alright, I want to thank you very much for joining us, and thank you everyone at home for tuning in, whether on YouTube or LinkedIn. Have a good evening!

For more professional insight on topics like on how to showcase your experience, get more freelance clients, or notifications about events like this, subscribe to our Freelancer newsletter or follow us on LinkedIn.