Blog •

Last updated on Feb 29, 2024

Live: The Art of Expat Taxes

Below is the transcript from our live presentation on expat taxes on February 26, 2024, led by Nicolas Castillo (CPA) from the Bright!Tax team. The talk covers helpful information for U.S. expats living abroad and freelancers in general, including how to avoid double taxation and penalties, how to claim stimulation payments, and advice for reducing your U.S. tax bill.

This transcript has been edited for length and clarity.

Skip to 7:13 for the start of the talk.

Today, I'll be talking about the art of expat taxation using U.S. filing strategies for freelancers overseas.

And we say “art” because a lot of times, it doesn't feel like a science. It's a lot of moving parts, and we're going to break it down for you and make you feel comfortable with being overseas and filing U.S. taxes. If you're moving abroad or thinking about it, this is the roadmap and how it might look if you do make the leap.

We’re going to start with some tax filing essentials from a U.S. perspective, then we’ll look at how to avoid double taxation when wrestling with the tax authorities in two countries, reducing your U.S. tax bill as much as possible, and lastly, we’ll talk about some strategies you can use to optimize your self-employment taxes in general, potentially looking at a worldwide perspective.

U.S. tax filing essentials to know

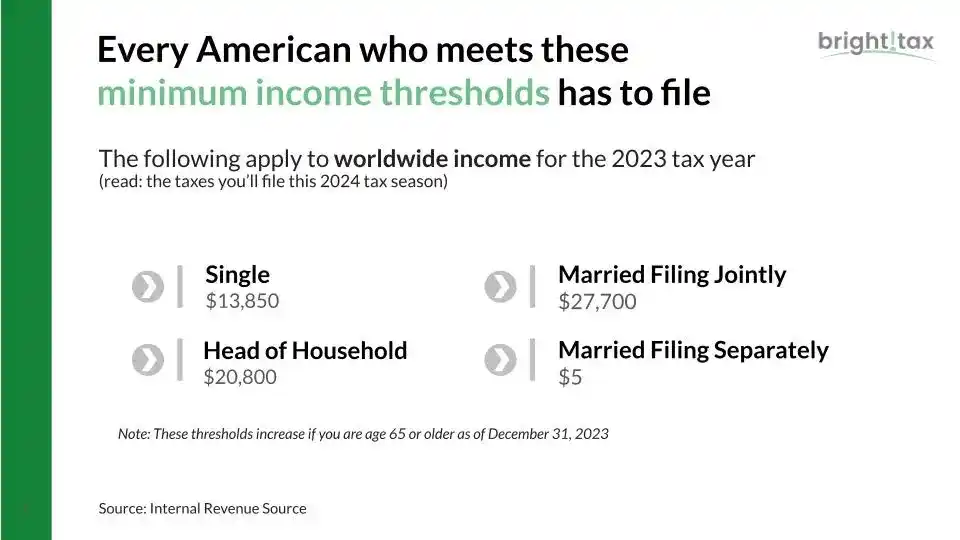

Every American who meets the minimum income thresholds has to file. And you may have heard about the different tax filing statuses: “Single,” “Married filing jointly,” “Head of household,” “Married filing separately.”

Each of those statuses has a standard deduction that is applied to it. In other words, it is an automatic amount of income that, if you are in the U.S., you get to basically write off, and you don't pay any taxes on that. For single people, it was $13,850 in 2023. So, when it comes to whether you have to file or not, you have to earn more than this amount in order to file the 1040 form during the year.

For single people, it was $13,850 in 2023. So, when it comes to whether you have to file or not, you have to earn more than this amount in order to file the 1040 form during the year.

Now, the one I really want to point out is “Married filing separately,” because if you are married to another American or non-U.S. citizen and you choose to file separately, you have to file if you earn more than $5 of income.

So, let's say you are married to a French person because you moved to France, you fell in love there and started a family but you don't make any income at all. Maybe you have $5 of bank interest. You still have to file because you hit this $5 threshold. That's something that some folks may miss, so just think about it as: “You have to file if you make more than this.”

Self-employment taxes abroad

If you're self-employed, you have a different threshold: if you earn $400 or more in any calendar year, then you have to file and report that income and report your expenses, if any.

And so, whether you're earning dollars or euros or Mexican pesos, you are always subject to U.S. tax as an American citizen. As a U.S. individual, all your worldwide income is going into this bucket to determine whether you have to file. So, whether you are abroad or in the U.S., it's going to come into this.

Let's say you are living abroad and you're working as a contractor for a U.S. company. That's considered reportable whether it’s paid into a non-U.S. account or a U.S. account. If it's paid in U.S. dollars or a foreign currency, it is all includable. So, even if you earn very little, you still have to report. This is very important.

Benefits of self-employment

Now, of course, being self-employed has a lot of benefits. You have freedom to choose your schedule and you get to go out on your own. But you do give up some of the benefits of being employed, such as healthcare, maybe a guaranteed paycheck every two weeks, and the fact that an employer actually pays part of your Social Security and Medicare taxes.

When you're self-employed, you're responsible for both the employer portion and the employee portion, which can come out to be a substantial amount of 15.3%. Social Security is 12.4%, Medicare is 2.9%. That's a tax that is imposed on the first $168,600 of your self-employed income.

If you earn more, you're exempt from the self-employment tax on the additional income, and that is in addition to regular federal income tax. So, when considering your total global tax rate, that's really important to remember.

Understanding FBAR and FATCA filing requirements

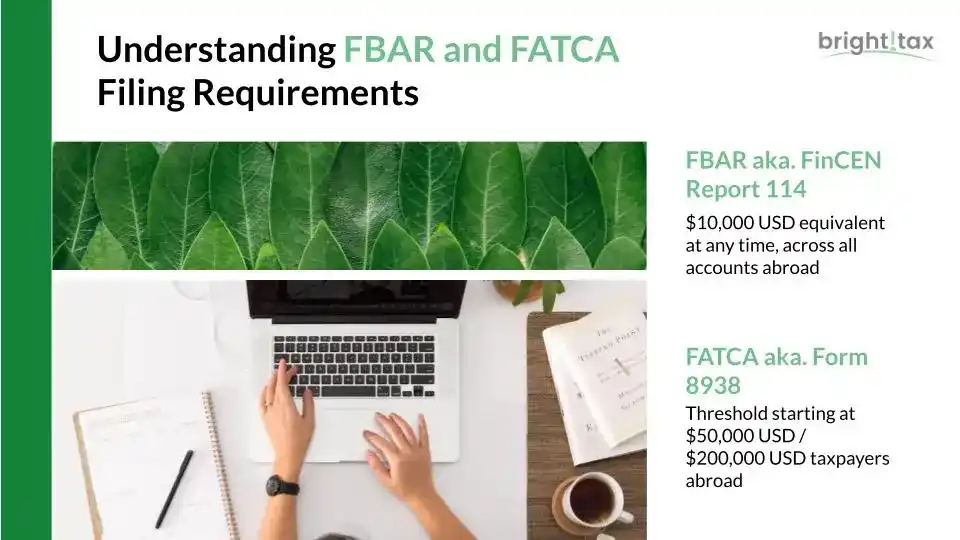

Another important filing requirement — we'll get more into self-employment later — is the FBAR and the FATCA filing requirements. These were both implemented to try to prevent Americans from keeping money overseas in unnamed, numbered accounts.

They require that the foreign bank reports your name and social security information to the IRS every year. It also requires that you, the taxpayer, report that same information to the IRS. They triangulate your funds and your bank accounts abroad in that way. And so, the FBAR, the Foreign Bank Account Report, also known by its official name, the FinCEN Report 114, requires that if you have a checking account, a savings account, a pension, any foreign financial account that is outside of the U.S. and, in total, has $10,000 or more at any time, you have to file.

And so, the FBAR, the Foreign Bank Account Report, also known by its official name, the FinCEN Report 114, requires that if you have a checking account, a savings account, a pension, any foreign financial account that is outside of the U.S. and, in total, has $10,000 or more at any time, you have to file.

Let's say you have three bank accounts — two checking, one savings — and you have $4,000 in each at the end of the year. You don't have $10,000 all at once in any of those accounts, but if you add them up that's above $10,000. That means you've triggered an FBAR filing. It is easy to not see that you have an FBAR filing requirement, so it's good practice to check every year with your accountant and see if that applies to you.

Very similarly, the FATCA report — the official form is known as Form 8938 — has very similar rules where instead of $10,000, we have to look at $50,000. That $50,000 threshold applies if you are physically in the U.S. So, if you have bank accounts, checkings, and pensions that exceed $50,000, you have to file this additional report. However, they wrote into the rule a break for people who are physically outside of the U.S., and they say, “Okay, if you have more than $200,000, then you have to file, but if you have less, you're exempt for now.”

These thresholds, $50,000 and $200,000, are for single filers. If you are two Americans that are filing jointly, living abroad, $400,000 becomes your threshold. So, you have to accumulate quite a bit of funds in your foreign accounts to meet this threshold for the FATCA.

Standard filing deadlines and extensions

Also important to know as Americans living abroad is your filing deadlines. April 15 tax deadline, right? Well, not quite. The April 15 tax return date is for Americans living in the U.S. When you are an expat, when you are physically outside of the U.S. during the April 15 deadline, you actually get a two-month extension until June 15. If it lands on a Saturday, like it does this year, you get to file on the Monday, the next business day, which is June 17. This is an automatic extension for expats. If we determine that you need more time, if you're waiting for an Australian tax return or some pesky document, then you can file an extension form to give you six months to file. Now, those six months will start from April. So, this year, it takes you to October 15.

If we determine that you need more time, if you're waiting for an Australian tax return or some pesky document, then you can file an extension form to give you six months to file. Now, those six months will start from April. So, this year, it takes you to October 15.

And this is also the extended date for the FBAR. The FBAR is filed at the same time as a 1040 (your standard tax return). But if you’re abroad, because expats get the two-month extension, the IRS wrote into the rules that the six months can apply from June, which puts us in December.

But the December 16 extension has to be specifically requested and mailed to the IRS. And by the time it comes to November each year, the IRS does shut down their electronic filing system. So, the December deadline should be an absolute last resort for expats, mainly because paper filing is slow, goes by snail mail, and it's just not fun to do.

The deadlines, these four dates — April 15, June 17, October 15, and December 16 — are really important. Based on where you are and where or how long it takes for you to get your documentation, we might recommend a different tax deadline for you to aim for.

Filing vs. paying

Notice that I've always said this is your filing deadline. That is because the tax due is always April 15, maybe June 17 with a two-month extension, but you should always expect to pay your taxes by April 15.

Even though you have additional time to file, that is very important. Part of that is that as a self-employed person, you are required to submit quarterly estimated payments to the IRS. And this is based on your projected annual income, whether you do bookkeeping and you have an idea of what you make every quarter, or you just have a good approximation of what your annual income will be.

The dates for paying your taxes that are important to remember for this year are April 15, June 17, and September 16, and also January 15 of the following year. In other words, it's 2 weeks — 15 days — after the close of the quarter.

Now, why is this even implemented? Why is this a rule? Well, think about when you're an employee of a U.S. company, you receive a W2 at the end of the year, you have a paycheck every two weeks, that company is taking some money from each paycheck to withhold for income tax, social security, and Medicare.

As a self-employed individual, the IRS still expects you to be making some form of payment. They don't want to wait a year and a few months to get their money from you. So, you do have to follow this schedule or risk penalties for not making estimated tax payments, so put it in your calendars.

About the streamlined procedure

For some of you listening, this could be news. This could be something that you've never realized: “Oh, I'm abroad. I heard that you can make $100,000 and not have to file a tax return.”

We've seen it plenty of times. There's 9 million Americans that are living abroad. And survey says that only 10% are compliant with taxes in the U.S., and that could be because of:

- lack of information, which is why we're here trying to educate the public;

- misunderstanding what tax treaties mean, it's a big one that we're going to talk about a little bit;

- thinking you don't earn enough or you have these thresholds, like a $100,000 that you're working with when really it's those lower ones that I mentioned earlier;

- bad advice from tax pros;

- you just had no idea you were really an American, which does happen often.

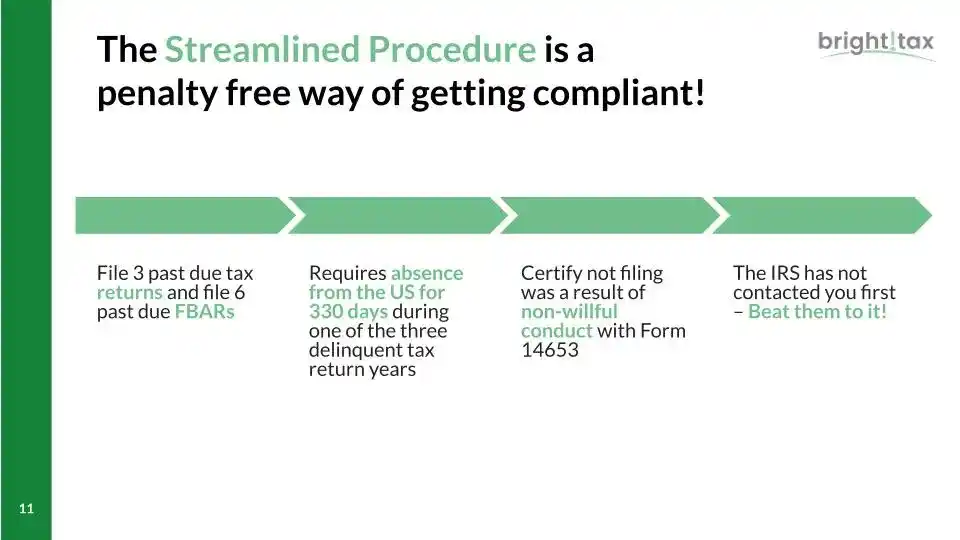

If this is you, there is a solution. The streamlined procedure is a penalty-free way of getting compliant. What this means is that you look at the last three tax returns that are late. Right now, 2023 is due in April of this year, maybe June of this year. So, 2023 is not on the list, we'd just be looking at 2020 through 2022.

What this means is that you look at the last three tax returns that are late. Right now, 2023 is due in April of this year, maybe June of this year. So, 2023 is not on the list, we'd just be looking at 2020 through 2022.

You file those three tax returns and six FBARs. We have to disclose and we have to meet the requirement of the taxpayer being outside of the U.S. for 330 days minimum during one of the three delinquent tax years.

We have to also certify that the taxpayer was not purposefully avoiding filing and there was some kind of mistake or misunderstanding as to why the taxpayer was not filing these returns, and that you file before the IRS realizes you haven't filed, or you beat them to it.

This is something that we can do. If this is you, I'll jump to it. You can reach out to us at Bright!Tax and we can help you get caught up in no time, in a no-stress situation. It’s penalty-free, so you’re not going to get arrested at the border, like some people have told me, and you won't be penalized if you have any tax due.

The only thing you may have is interest based on what you owe for the time that’s passed, which is minimal compared to what some people may see online and get afraid of when they see the scare tactics out there.

Avoiding double taxation

You may often hear that the U.S. has a double tax treaty with several other countries around the world.

This is great in a lot of ways, but it is not the end of the discussion. Now, I want everyone to think of the tax treaty as an agreement between two countries for the benefit of their tax authorities, not the benefit for the taxpayer.

So, when you go to do your tax return, we can't wave a wand, say “tax treaty,” and there goes all your taxes. However, there are some really important parts about tax treaties that make it a really, really useful tool.

For example, certain countries have tax incentives that will drive taxpayers or influence taxpayers to make a decision. One of these is in the U.K., where you can take 25% of your pension totally tax-free in the first year of your retirement, encouraging you to have a nice, happy retirement.

The U.S. rules, if they were to just tax that like a normal pension distribution, that would disincentivize and discriminate against those U.S. citizens that are also trying to take advantage of this incentive. So, the tax treaty obliges each side to play fair and allow these things to happen.

It's a great thing to have in your pocket, but it's not the end of the world, or not the end of discussion. Mainly because there is a savings clause. I don't want to get too much into what the savings clause is, but just remember that this is a contract between two governments, and when there's a savings clause in that contract, it's saving the tax authority the right to tax you. It doesn't save us, the taxpayer, from tax on that income.

That's really important. A government can basically say, “No, I'm going to use the savings clause and I'm still going to tax you, even though the treaty says something different,” which is part of why this is such a big deal when doing your taxes and you have a treaty involved.

Thankfully, all that I said is not going to apply to most people because the United States Code and Regulations provides for some double tax relief for Americans abroad, so we don't even need to go into tax treaties with other countries.

So, number one of these provisions is the foreign tax credit. This is effectively a non-refundable credit for taxes that you have paid to a foreign government on the foreign income that you earned that was taxed in that foreign country.

What does that mean? Let's say you're in Spain and you are working in Spain, you have your business profits and they're subject to tax in Spain. Seeing that you're a U.S. citizen, you’re taxed on your global income, so the U.S. is going to say, “Hey, I want a bite of that.” And you're going to say, “No, look, I paid X% of tax in Spain on this income, you want to tax me Y% on that income. I'm not going to pay you again.”

Let's say you paid 20% tax on that Spanish business profit, and the U.S. says, “Okay, I want to tax you 18%.” You're going to be able to say, “No, I paid 20 over here.”

So, your 18% is brought down to zero, right? You're not going to pay that 18%. And that difference of 2% extra that you paid in Spain will get carried forward into a future year to offset potential future U.S. tax.

So, the main point is that you will not be double-taxed. And if for some reason the U S. tax rate is higher than the local tax rate, then you will just pay the difference between the U.S. tax rate and the local tax rate. That's the foreign tax credit.

The other option, the foreign earned income exclusion, says that if a taxpayer is abroad for either 330 days out of a 12-month period, or they are just a truly bona fide resident of that country, then they can exclude up to $120,000 of their earned income from U.S. tax.

What does this mean? If you are earning income, whether that's a salary or a business activity, you are able to exclude $120,000 of that from your taxable income, which comes out to be about $17,000 or $18,000 of tax savings, just because you were physically outside of the U.S.

Now, that $120,000 changes every year. It's adjusted for inflation, so next year it might be $126,000.

There's also, as part of the foreign earned income exclusion, a Foreign Housing Exclusion which basically gives you an extra little bit of exclusion for the cost of living wherever you are. We won't get much into that, but that's a great benefit too.

Foreign tax credit vs foreign earned income exclusion

Foreign tax credit, foreign earned income, which is the best one to use? It really depends on the circumstance, right? A foreign tax credit will only work if you've paid foreign taxes, so it will never benefit you if you are living tax-free in Thailand or paying 5% tax out of Panama, for example. Whereas for the foreign earned income exclusion, you have to meet two criteria: you have to be physically abroad for 330 days or more, or you have to be a true resident, and it can only be applied to earned income.

A foreign tax credit will only work if you've paid foreign taxes, so it will never benefit you if you are living tax-free in Thailand or paying 5% tax out of Panama, for example. Whereas for the foreign earned income exclusion, you have to meet two criteria: you have to be physically abroad for 330 days or more, or you have to be a true resident, and it can only be applied to earned income.

So, if you have a rental property, a pension income, or you have some huge capital gains through cryptocurrency, for instance, all of those items are not considered earned.

It's really important that we pick and choose based on your situation. Really generally, here in Europe, taxes are pretty high by U.S. standards, so the foreign tax credit is usually the one stop. But as any good advisor would do, we would aim to use the foreign tax credit and we would want to check and just make sure that both situations have been considered.

Reducing your U.S. tax bill

Now that we've talked about avoiding double taxation, you're effectively being taxed only in one place. So, how do we reduce what is left over in the US? How do you keep your U.S. tax bill as low as legally possible?

One really great option is the Child Tax Credit. This is something that can be missed very easily. It's effectively the U.S. government compensating you for the trouble of having kids. Kids can be a little less taxing, right? So, the Child Tax Credit is a non-refundable amount that reduces your tax due.

I think you get around $2,000 per child depending on the age and depending on the dependent status, which is non-refundable. But $1,600 is refundable for each, depending on certain cases. So, that's really great money into your pocket.

However, there is a combination of the rules that say that we cannot take a Child Tax Credit if we take the foreign earned income exclusion.

In cases like this, where you have a child and you're in a low-tax country, for instance, we would have to determine what is the greatest tax savings, whether it is eliminating $120,000 of income from your taxable income and forfeiting the tax credit, or maybe max out deductions where we can, but we take the tax credit for the Child Tax Credit.

So again, it's lots of moving parts. It’s really important that we talk about it, that we understand everything going on.

Another important piece, if you're in Portugal, let's say, and you're self-employed, you're working from there, you're paying federal income tax to Portugal. Portugal is still going to want you to pay social taxes. If you're a resident, you're going to be using up the social infrastructure there, you're going to be paying into the system.

So, there is a very nice tax treaty, which is slightly different, called a “totalization agreement” between several countries and the U.S. that says, “Look, this taxpayer is paying into the system in Portugal. Because they're paying into that system, they're covered by that system, then they are exempt from the U.S. system.”

So, you can be in Portugal paying a lot of income tax and social tax, but you can purely eliminate the U.S. social tax just because of the totalization agreement. And maybe that's a little bit of a simplification, but that is a short way of saying it. The countries that we have the totalization agreement with are not all the same.

If you are moving to any of these countries — Australia, Austria, Belgium, Brazil, Canada, Chile, Czech Republic, Denmark, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Japan, Luxembourg, Netherlands, Norway, Poland, Portugal, Slovak Republic, Slovenia, South Korea, Spain, Sweden, Switzerland, the United Kingdom, Uruguay — and you are going to be a resident paying taxes there, you can basically offset the 15.3% social taxes that you would pay in the U.S.

Avoiding Penalties

Another important part about keeping your U.S. tax bill low is to make sure that you don't rack up any penalties.

We talked about filing on time based on the filing dates and the extensions, meaning, you're making your estimated tax payments on time, you are paying your actual taxes by April 15, and you're not waiting until the last minute when you file in December to pay.

Those two things will save you a lot in penalties. Penalties, in a worst-case scenario, can be 25% of the total tax due. In some cases, it's 5% to 10%. So, really an important part to keep your total tax bill down is to avoid penalties outright. If you're abroad and you're having these other activities, then you might have some international business disclosures. These are if you have a foreign registered corporation, you may be required to file Form 5471. If you have a foreign partnership, you may be required to file Form 8865.

If you're abroad and you're having these other activities, then you might have some international business disclosures. These are if you have a foreign registered corporation, you may be required to file Form 5471. If you have a foreign partnership, you may be required to file Form 8865.

If you have what's called a passive foreign investment company, or a PFIC, then you may have this Form 8621. To explain a little bit about that one, let's say you're invested in foreign mutual funds as part of a pension or as part of your investment plan as a person living in Portugal, Spain, France, the U.K., Ireland, wherever, and you have one of these foreign mutual funds, you have to report it every year on this Form 8621, and you have to potentially pay tax on the unrealized gains of that company.

That's a real big issue and definitely a topic for another time, but if that is something that sounds like it might be your situation, then do reach out.

If you fail to report all these international business disclosures or you file inaccurately, the penalty can be as much as $10,000 per year.

The same goes for the FBAR and the FATCA, where you can have a $10,000 per year failure to file penalty. And if you have three years of this built up, interest will accrue and it can just get really out of hand if you spend too long without reporting these.

This brings me back to talk a little bit about the streamlined procedure. If these situations occur for you then the streamlined procedure will prevent those penalties. It’s a really generous offer by the IRS to help you get in compliance, and it's just a promise that you'll keep being in compliance in the future and you'll file these forms on time.

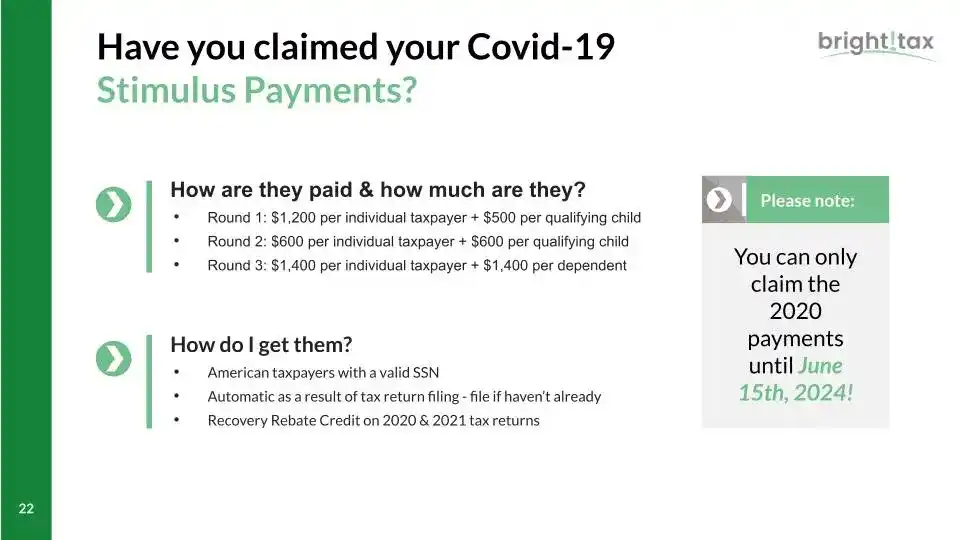

Claiming your Covid-19 stimulus payments

Something that’s maybe more good news than bad is the Covid-19 stimulus payments. As some of you may remember, in 2020 and 2021, the U.S. government did announce that they were going to be issuing some stimulus payments to every American based on certain income levels, and even if you were an American living overseas or you didn't ever file a tax return ever in your life, you might not have realized that this still applies to you. The way to claim an unpaid stimulus payment is by filing a tax return. The payment amount in round one was $1,200 per individual plus $500 per child. Round two was $600 per individual taxpayer and child, so per American in the household. And round three was $1,400 per individual American in the household.

The way to claim an unpaid stimulus payment is by filing a tax return. The payment amount in round one was $1,200 per individual plus $500 per child. Round two was $600 per individual taxpayer and child, so per American in the household. And round three was $1,400 per individual American in the household.

Let's say you're a single individual, that's a total of $3,200. If you have children and you're married, that can be much higher. As long as you and your children had a social security number and you file the tax returns, you should be getting this.

You can only claim the 2020 amounts, so rounds one and two, on a tax return filed before June 15, 2024, so there’s almost less than four months to claim this. If this sounds like you, please do act fast so that you don't leave money on the table.

Strategies to optimize self-employed taxes

Now that we've talked a whole lot about reactionary items, you know, you just realized you have to file, you have a business overseas, you got to file a foreign corporation disclosure, let's say you know all these things. What can you do to make your tax situation better as a self-employed individual? Expenses. Maximizing deductions is really important. Number one, home office. If you are a remote entrepreneur and work from home, you can take your home office as part of your business deductions. Because it's a true, genuine use of your business at home.

Expenses. Maximizing deductions is really important. Number one, home office. If you are a remote entrepreneur and work from home, you can take your home office as part of your business deductions. Because it's a true, genuine use of your business at home.

Let's say that 30% of your home is dedicated to your business. It's where you keep all your documents. It's where your computer sits. It's where you sit. That will be 30% of your total rent, utilities, certain repairs, and maintenance costs that you can take as a home office deduction. That's one of those things that's really personal expenses that you can take towards the business, so don't sleep on that one.

Assets. Let's say you buy a computer, or you're recording your YouTube videos and need a microphone for speech-to-text. All those are assets that you can write off effectively via depreciation, which means that you write it off slowly over time, over the life of your asset, or you can write it all off at once if it qualifies for certain provisions, which we won't get into now.

But advertising, branding, promotional activities, anything that is related to your business that you make as a payment, you can include that. Vehicles, health insurance for you and, if you have them, contractors or employees. Legal and professional fees, so, you know, you pay an accountant the big bucks to advise you or a lawyer or any kind of consultant, all those items can be taken as an expense in certain countries.

It's important to note that you will have different deductions and different credits than what you would have in the U.S. So, let's make sure that when you're doing your work in the Netherlands, talking to your Dutch accountant, that you don't take all of those expenses as gospel for the U.S. side because we could have different rules.

Now, how can we be even more proactive other than just thinking about what expenses you're planning to take? I would say there's several different ways to do it in the U.S. with a U.S. LLC, a U.S. corporation, a U.S. partnership. When you think about the foreign tax side, there could be foreign companies that you can register that play a part in this. We've seen tons of tax structures that benefit and detriment the taxpayer, so I would love to help you get your tax structure into place to be in a really beneficial situation.

Let me give a few very quick examples. Say you're in a country like Mexico, you're not paying any federal income tax there, you're not paying any social taxes. There's no totalization agreement with Mexico.

So, all of your income will be subject to U.S. federal tax, U.S. social security, and Medicare. Now, there's three taxes there. The one, the federal income tax, that's 400 income exclusion. We can wipe out 120,000 of that, but your social security, Medicare, since there's no totalization agreement, that's 15.3% that you're paying.

That hurts. Now, what you could do is set up a U.S. S corporation. A U.S. S corporation allows you to pay yourself a wage. That wage is the only part that is subject to Medicare and Social Security, and the remainder of your profits is only subject to federal income tax.

That is one thing that works great for entrepreneurs in Mexico. But if you're an entrepreneur in Spain, then you're paying Spanish taxes, paying Spanish social security taxes anyway, you would have qualified for the totalization agreement. So, the S corporation — which its main purpose was to limit your social tax — is almost there for no reason.

A better situation in Spain would be to have a U.S. C corporation, which has a bunch of other supporting reasons why that makes sense that we don't have time for today, but I really hope that if you have a situation — you feel like you're paying more than you should in the U.S. and potentially in Spain or wherever you're living or planning to live — then please do reach out and we can see the best way for your business to operate so that your taxes can stay as low as possible worldwide and that all your wealth can grow a little bit safer and faster.

So, to summarize: the key reasons to explore new options include:

- residing in a country without a totalization agreement, affecting how your business and personal contributions are taxed;

- facing high tax rates on business income in your current country of residence;

- seeking benefits from another country’s banking system for financial or operational advantages, putting you in markets that you'd like to be.

For more tips on how to create an effective freelancer profile, get more clients, or notifications about events like this, follow us on LinkedIn.

Speaker bio: Nicolas Castillo, CPA, representing Bright!Tax, is a renowned expert in international taxation, holding a Master's in Taxation from the University of Miami. With over five years dedicated to specializing in U.S. expat taxes and currently residing in Spain, Nicolas leverages his extensive IRS Tax Code expertise and personal expat experience to assist Americans worldwide. Committed to educating and empowering his clients, Nicolas offers tailored strategies for small business owners and individuals to navigate the complexities of expat taxation effectively. His client-centered and educational approach makes him a trusted advisor in the field of expat taxation.