Amazon Book Market Secrets: Lesson from 7 Years of Data

15:00 EST - Oct 27, 2022

This transcript has been edited for clarity.

For free sample genre seminars and more, use this link to K-Lytics.

We have a lot of material to go through. Today's topic: Amazon Book Market Secrets. There are secrets, and we've been looking into Amazon numbers for seven years now. We wanted to give you some of the lessons learned from all this market monitoring. We're gonna look at some longer-term trends, shorter-term trends, overall observations out of all these years, and also look at some more recent things.

Amazon Talk: Fact or Fiction

Whenever you go into Facebook groups or into these webinars and people talk about Amazon, there is often a lot of hearsay. Hey, did Amazon change its algorithm? Or just very recently, obviously something did change in the best sellers display. So Amazon is always changing and authors and publishers are trying to catch up. Since Amazon, frankly, does not publish a lot of things, they have a complete Chinese wall with other departments within Amazon and almost a complete shutdown towards the external world.

You don't find them talking a lot about the internal things, and, obviously, not about the algorithms. You get a lot of talk about fact and fiction. Today we're also gonna talk about nonfiction, pun intended. The numbers I'm gonna present to you are basically from the screen as you watch the website, Amazon.

So it's not internal numbers. It is as if you were visiting the store and doing so many, many times over the years. More about that in the second.

Insights from working alone

Now, why is this important? When you work alone as an author or publisher, of course you have your own insights. If you're already a bit more experienced, you may have published one or another book, perhaps you have a whole portfolio of books here.

You run your marketing campaigns, and you sort of sit in front of your notebook and say, “Okay, book three, promotion 12, this worked.” From this insight, you then progress and you have your own little world where you find out what works for you and that is the best starting point. You are your own consultant.

Working with your author friends

Then many of you join these types of talks or webinars.

You are in Facebook groups and you will have a lot of insights from working with other author friends. That's great too, because collaboration, in many, many cases, helps. Where it can get a bit touchy is where you have hearsay going on. Just because two people had success with something does not mean that the other 1000 people in the Facebook group will have success following the same strategy.

Working with thousands of books

Therefore, what we strive to do is basically look into, not the data of just one book or 15 books, but we're working with thousands of books. In fact, millions of books over the years, looking at their performance, at their sales ranks, at their prices. Are they in KU (Kindle Unlimited) or not in KU? Are they a series? Are they a standalone? What type of genres are they?

From that, you can distill insights, and I hope that I'll be able to convey some of these insights today. Now, if you're not a math genius, don't worry, because my mission is to bring everything to you in a very palatable format. So the only qualification that you have to have for today's webinar is if you can read this chart and find out what percentage of the chart looks like Pac Man, then you are in a very good position to understand the data that I will present today.

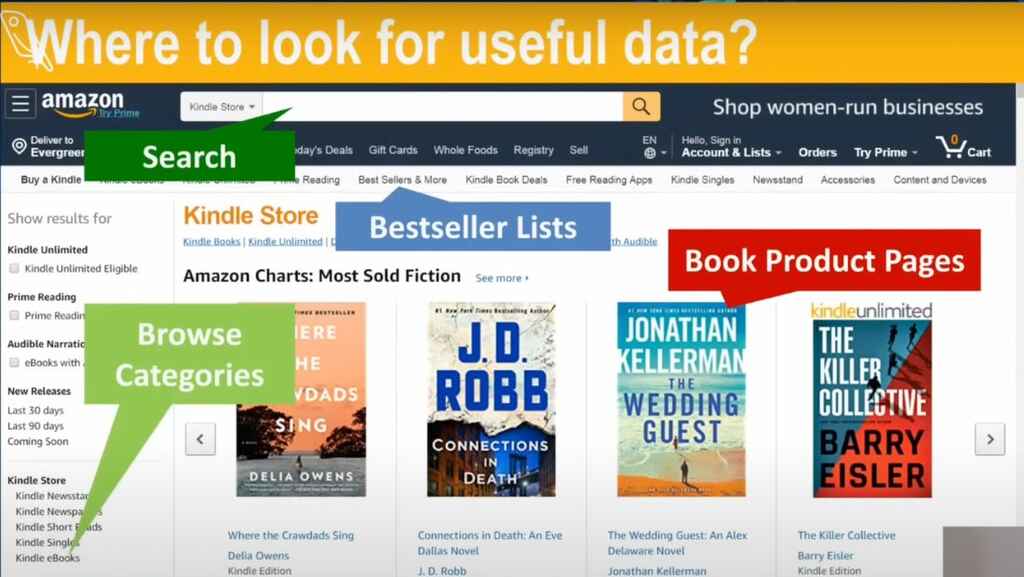

Where to look for useful data

If you go on Amazon, a couple of introductory notes, which are very important though. There are many places on the Amazon site where you will find very useful data, especially if you look there frequently. You have the search, you have the browse categories, you have the best seller list, and you have the individual product pages.

However, there's one very important factor. Obviously, the book market and the Amazon website in specific is very, very dynamic. That is to say, if you're researching for your book, you want to find out things about your competition, or you simply want to look for a trending book, then you will find that on the book page. There is, for example, an Amazon bestseller rank, which for many is a very, very important indicator because it shows at least the relative performance of that very one book. Relative to what?

Well, relative to all the other 9 million English speaking titles you currently find in the Kindle store. As an example, if you're into ebooks and – here comes a very important point – it is sales and borrows that drive the performance of that sales rank.

Avoiding the real time trap

What can happen if you just look at sales rank at one point in time is that you walk into what I call the “real time trap.”

Because you can browse the Amazon website yourself, there are certain, sometimes other real time tools, that may help you with analyzing best sellers. But the point is this: say the red dots here that are connected with a red line, they are momentary sales ranks of an hour of a day in time.

Let's say this is day number one of the observation. This very book has a sales rank of 342,421. Now, especially if a book is trending very low, it can just take a couple of friends' purchases to drive up a sales rank significantly. Now, not into the top 2000, but say this book has just done a big promotion. Within a very, very short period of time, in a matter of days or one day, the sales rank is driven up all the way here into the top 2000 of the Amazon Kindle store.

That can happen if you have a big promotion, if you have a BookBub or one of those sorts of things. What happens, though, is as time goes by is that the score you have in the algorithm at Amazon for that very one sales rank is basically halved every day. So very quickly a book can fall back into oblivion if no continuous marketing happens, especially here in the low ranks.

This means if you just happen to browse your genre on one day or you are using real time tools that monitor Amazon or help you monitor a best seller list, you can fall into this trap that what you think is trending is actually not trending. So the data that I'm gonna show you today is not from one momentary observation, but it basically takes thousands of observations to then produce a meaningful average number, whether that number is a price point or sales rank.

This is basically what we do at K-Lytics.

So here is another real example. Here you have a book that is oscillating over a 90 day period, the sales rank goes up, goes down, and you can immediately see if you look at that book at a low point, you have the wrong conclusion.

If you have it at a high point, you also have the wrong conclusion as to how well it's really doing. You see that also as you look at this, over time, the average may move up or down. This starts to give you insights into trends. I hope I can show you a couple of these longer trends that we've been observing over the years.

Connecting with your readers

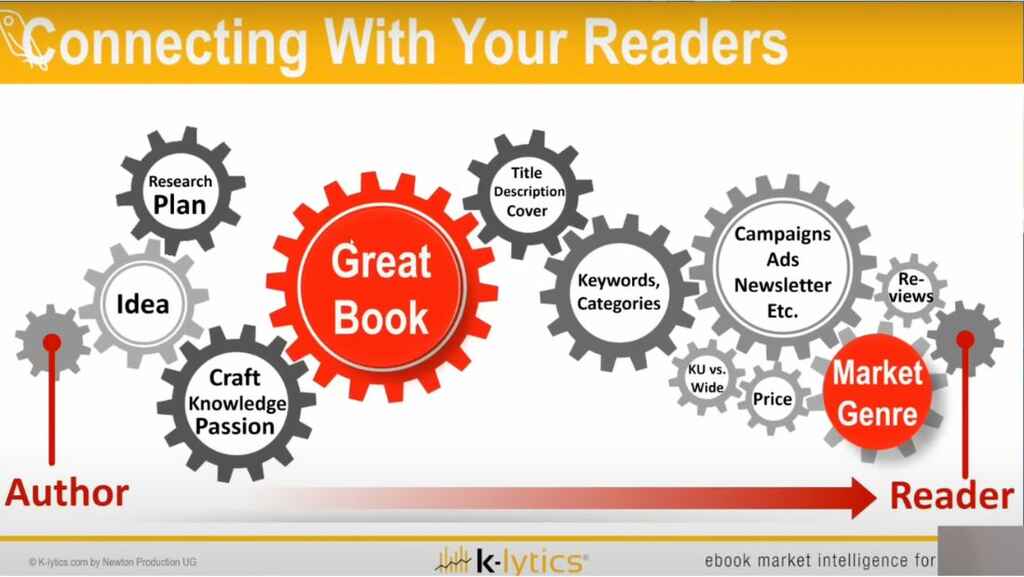

Today, all of this is done with a purpose, and the purpose of the data is not to serve itself. It's to serve you and to help you with that connection to your readers. Now, you're the author on the very left hand side of this picture, where you start with a good idea, you have a plan, and you have the craft knowledge and passion for whatever book and genre you're working in.

Finally, you have that great book. Then the rest of the journey to ultimately connect with your reader can become pretty tedious and sometimes mechanical or more mundane than just having this great pleasure of creative work when you come up with your work of art. I will try to show you trends specifically within those things, whether it's titles, key words, or categories.

I'm not going to go into campaigns today. We're gonna look at KU, we're gonna look at pricing and reviews, so all these mechanical things here to the right hand side of the equation. But also, what can you do at the idea stage and, even at the writing stage, to better make that connection between your idea and book and your reader?

The Market

All right, let's dive into one of the first of these cogwheels here. First of all, the individual reader. If you write, you obviously want to have an emotional impact on the prospective reader, that one individual. But it's hopefully not just one individual that will buy your book, but a whole group of people.

You can talk about this group of people as a part of the book market. They may constitute fans for a specific genre or subgenre.

But, in essence, we're talking about markets and specific submarkets of the book market. The beauty of any market is there are some very basic laws, whether it's books or spices.

I like spices because they have something to do with taste, like books. But they have something to do with very simple economics, the supply and demand of spices. At the street market, do you have many, many, many people selling cardamom or cinnamon, or is it just very few? Are there lots of people requesting it or very few?

You get the idea. The basic laws of supply and demand kick in very, very quickly.

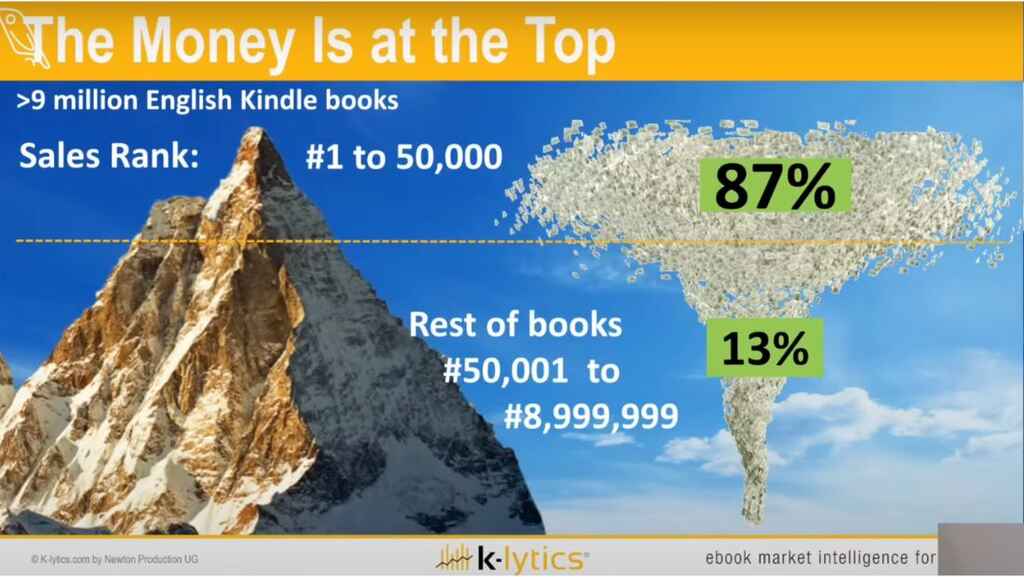

The money is at the top

From the demand, money is earned. From that earned money, money is being paid out. If you look at the Amazon sales rank, it's a bit like climbing a mountain, where on the very left hand side, the tip of the mountain is, say, sales ranks one to 50,000 of these nine million books.

We’re already at 50,000. You are not selling a lot. We all know if you're in the very top of the store, if you're on page one, a lot of money is being earned and paid out. Overall, at least 87% of all that money is made at the very tip of the mountain, and then backlist down to 50,000. That's where you hardly sell a copy a day as you go along.

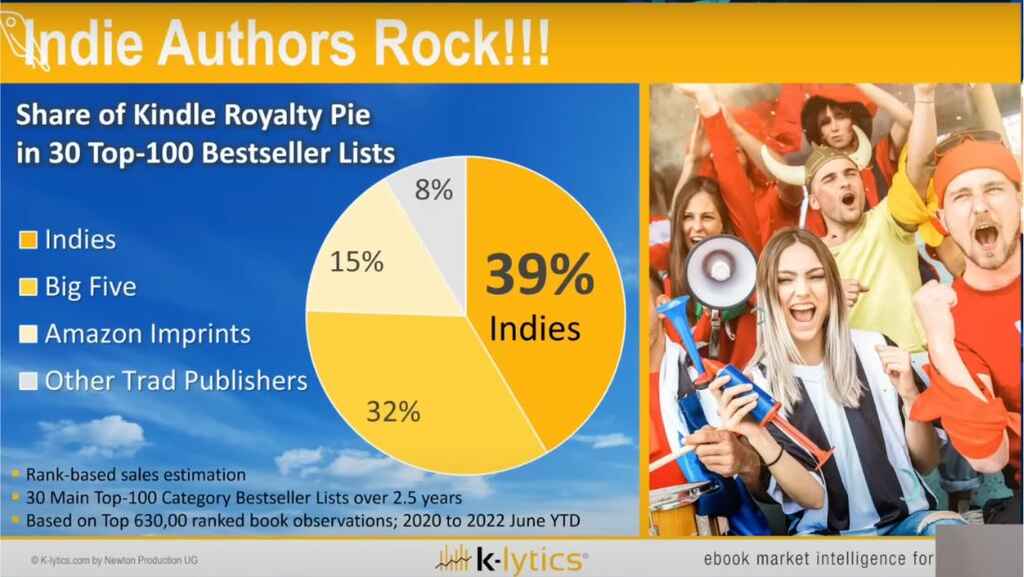

Indie authors rock!

So the big question is if, if all the money is up there, who's earning the money? Here, I hopefully have some very, very good news for many of you guys who may consider yourselves indie authors, because it's the indie authors who rock this game.

Over two and a half years, we looked at 630,000 ranked books or ranked book observations across the 30 main top best seller lists that you find on Kindle. So it's not just romance, it's not just mystery, it's basically a cross section of those 13 main genres, which span fiction and nonfiction.

Indies, according to our calculations, make up 39% of the royalty pie, more than the Big Five publishing companies, more than the Amazon imprints. You can give yourself a big, big pat on the back.

It's a great time to be an indie author. It's a great time to be writing. Amazon is just one place that shows how successful indie authors are and hopefully you're also using Reedsy and that's why you're here on that journey to success.

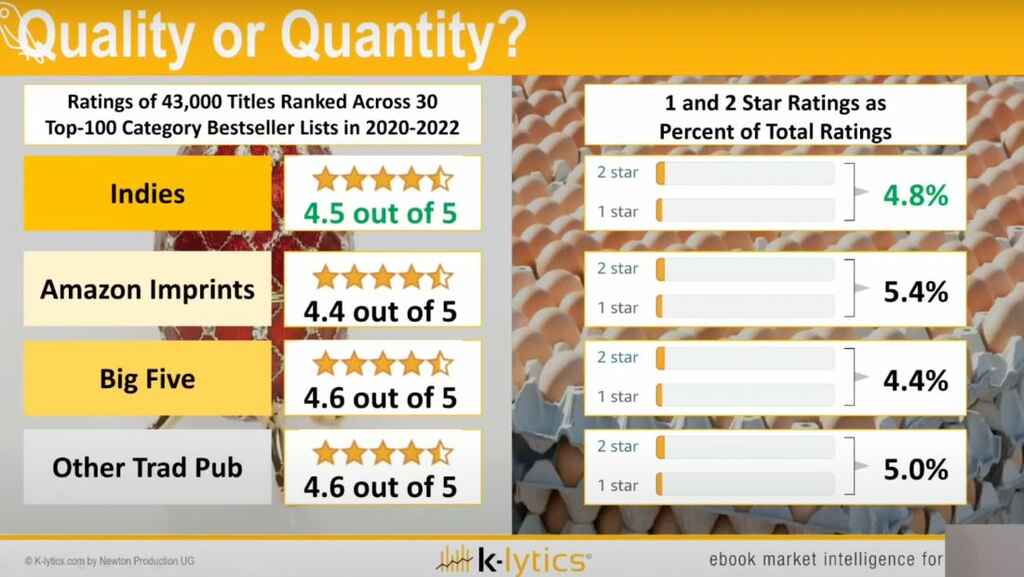

Quality or quantity?

Sometimes your friends and family may frown at you. “Yeah. You're just an indie author. Isn't that just books that are not so good?” Well, have a look at this one here. Is it just lots of junk books being turned out or what is it?

The fact of the matter is that when we looked at the quality ratings or star ratings of 43,000 titles ranked across these best seller lists over one and a half years, indies get 4.5 out of 5 stars. Amazon even less, 4.4 stars. Big Five: 4.6 stars.

There is no quality issue or quality gap. Quite the contrary. If you turn it around and ask, “Well, but aren't there many bad reviews?” Think again, the percentage of one and two star ratings out of all the ratings that indies have is 4.8%.

The lower the value, the better. Amazon imprints have more bad reviews. Big five, a little less. But you get the idea. There is no quality gap between you publishing on your own and the big publishing companies, at least in the grand scheme of things.

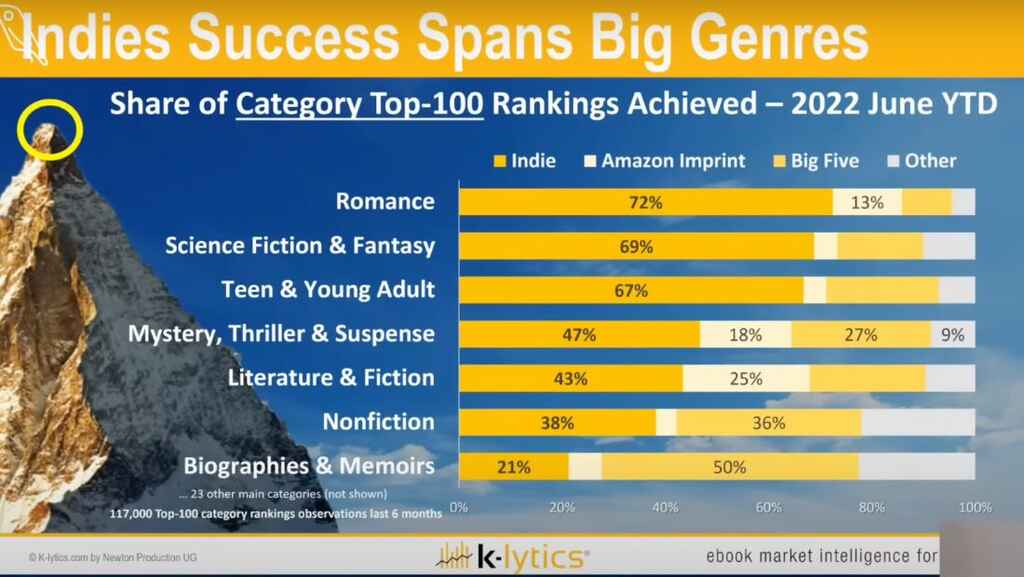

Indie success spans big genres

If you then break down that chart, by genre, especially in the very high selling genres, you will see that indies’ success does span the big genres quite significantly. So in romance, 72% of that best seller list over time is indie. Sci-fi and fantasy, 69%. Teen and young adults, 67%. Mystery, thriller, suspense, the genres most heavily contested by the big publishers, 47%.

What more do we want? I think this is just a marvelous story for the many of you who are here listening to this session. Of course, you may not have had success yet. The point here is to say it is absolutely possible, and it's not just a hope or dream.

It is happening as we speak and has happened over the years as the numbers have shown you.

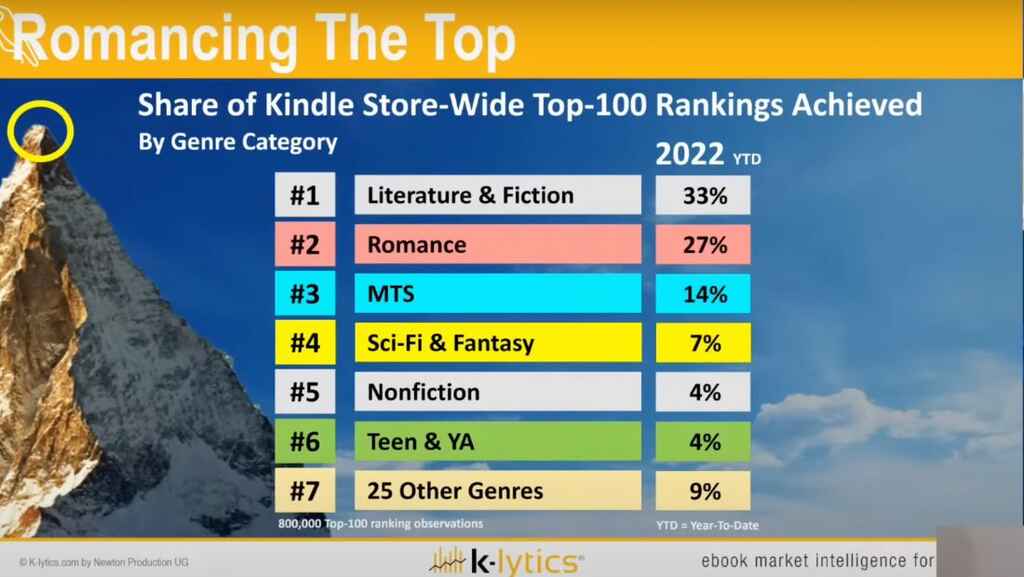

Romancing the top

Now, if you enter that game of writing your book you should be aware of where the market is headed and who are the best mountain climbers there? For example, genre-wise the very top of the mountain is constituted by literature and fiction; then romance; then mystery, thriller, suspense; then sci-fi and fantasy; and then non-fiction. Then teen and young adult, and then you have many, many more genres in our tool.

We track this down to a very minute level, starting from the big genres. For example, this month, romance contemporary would be number one, thrillers number two, women's fiction, number three, and this is the top of 8,000 genres.

You could go down all the lists to the very, very bottom. Where, if you are into, say, nonfiction arts and photography, photography, travel, South America, there, the sales rank is only 3.6 million on average across the top 20 titles in the category. Basically, zero sales per day. So you have to make your choices wisely.

But the point is, if you are going for some of these bigger markets, romance, MTS (mystery, thriller, suspense), sci-fi and fantasy, you cannot go wrong. But within those, it's competitive, so you also wanna drill down and find your specific niche, but the overall climate for these genres is really good these days and has been over the years.

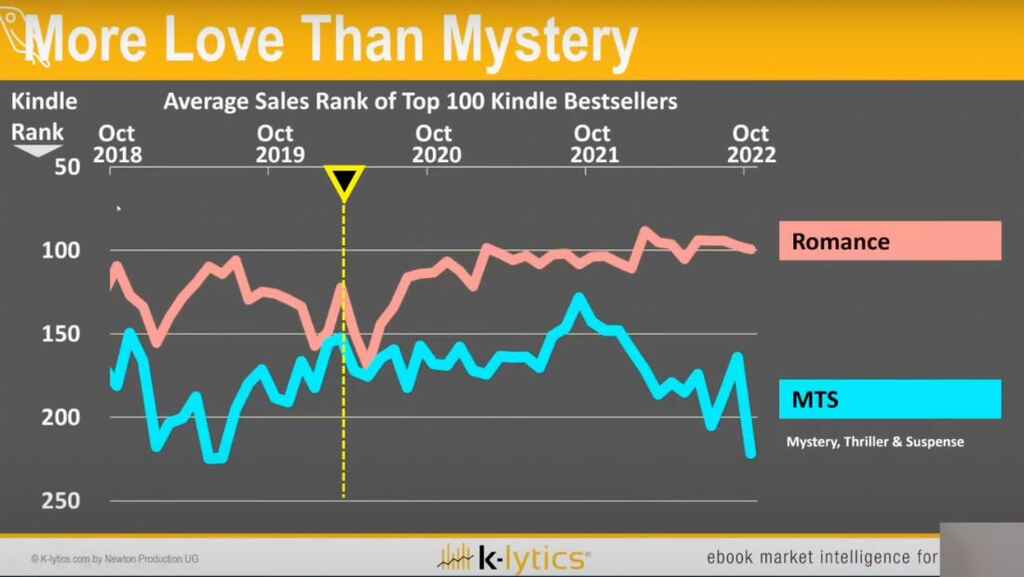

Trends over the past five years

Let me just show you some stats from the past five years. That little black/yellow triangle shows that famous infamous period that started in March 2020, which we all know. Since then romance has been a clear winner. Mystery/thriller/suspense has done very well intermittently. Over the last year, it’s been a bit weaker.

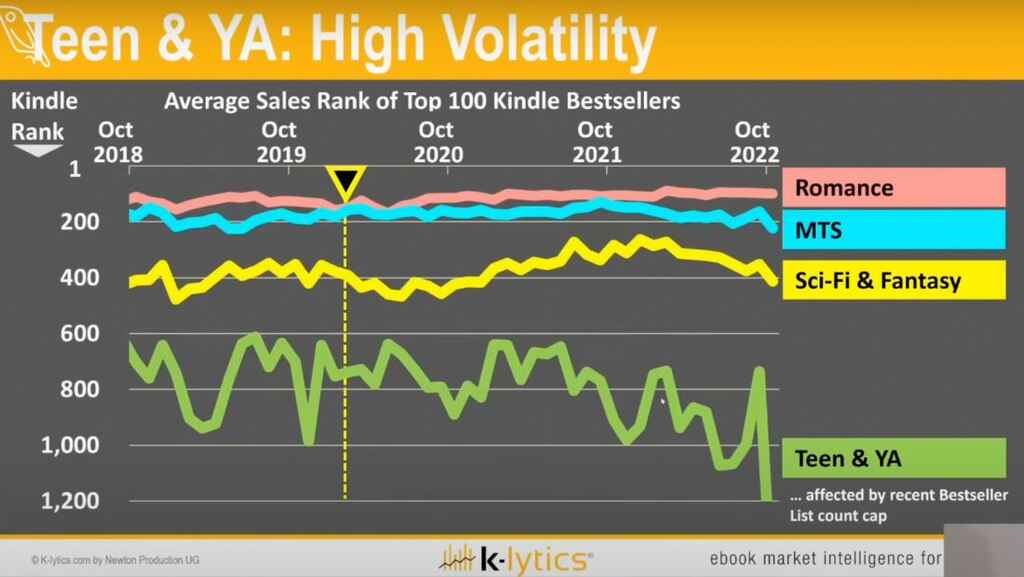

This is the average sales rank across the top 100 titles, which monitors thousands and thousands of books over time. The average across the top 100 [titles] for romance is actually 100. The average for mystery/thriller/suspense out of the top 20 titles achieves an average, out of the 9 million, of around 200, so really at the top of the store.

Now to plot other genres, you actually have to squash those two lines together a bit, which opens up space, for example, to see how sci-fi and fantasy has been doing. There we've actually seen a strong rise ever since the start of the pandemic all the way into the end of 2021.

Now, in 2022, we've seen a bit of what I'd call the post-covid cool down for sci-fi and fantasy. By the way, a lot of that peak that you're seeing here in the year 2021 was also driven by lots of sci-fi romance titles because many science fiction romance titles had some viral moments on TikTok driving up the whole curve.

Then further squashing the axis here a bit gives us the line for teen and young adult. Now, teen and young adult were also affected a bit by the recent best seller list count cap. I won't get into the details of that, but in recent months, you could put your book into 10 categories. You still can do so but on the book page only three categories will be displayed.

But you could rank into more than three best seller lists. Amazon seemed to have started capping this, which drove a lot of high ranking romance titles out of the teen young adult best seller list because they're ranks were already achieved in romance best seller list.

So there are a couple of things happening currently, but the overall trend, I think is what it is.

The Kindle star chart

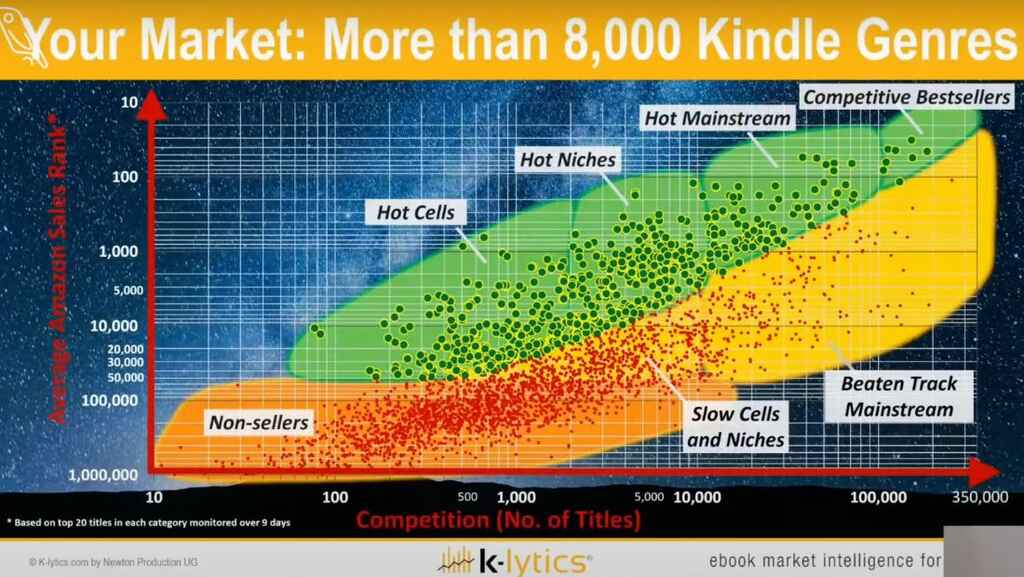

Opportunities abound when it comes to genres, when it comes to tropes. This is a picture I love to show at every webinar because every star in the sky could be an idea for a book, a subgenre, some tropes, some location, some characters.

If you just think about a star as a category, you could draw this map. There's a map, which we've been drawing every month for the last seven years, which is a market of more than 8,000 Kindle genres. If you’re an indie author, you're also a business person by definition, basically.

You will have to think about supply and demand in various markets. That's exactly what this chart is showing. Every dot is a category and the higher the dot is on this slide, the better the average Amazon sales rank, which we've already talked about. The further you go from the very left to the very right hand side on the image, the more competitive it gets.

You have dots on the very left hand side of the graph where you have barely a hundred titles in the category. And you have dots that go way beyond the 100,000 mark. Think about contemporary romance as an umbrella category, which is super high up on the chart, high selling, but also very competitive.

Now, if we just looked and filtered out of the table only those categories that are in mystery/ thriller/suspense. We would just focus here on mystery/thriller/suspense. Also, you have a ranking of categories where at the top you would have thrillers, then you have suspense, then you have psychological suspense and so on.

If you plot all these, which we did here and which we do every month, you get to pictures like this where, for example, you have domestic thrillers trending, which are basically psychological thrillers that happen in the confines of the neighborhood or home. The sales are sky high.

The average across the top 20 [titles] is around sales rank 1000 and you have only about a thousand titles in the category. So if you are into mystery and thrillers, look at domestic thrillers.

If I move across the data for this and we connected and had a look at what that genre is doing on the Amazon store, you will see a lot of these books, which constitute a very, very thriving market of the current mystery/thriller/suspense landscape. So have this in mind when you think about your next book project. There are the laws of supply and demand at work, and you want to specifically watch out for those [genres] where you hopefully have high growth.

High demand, that is high sales, but as little competition as hopefully possible.

Categories and Keywords

Now, for a moment, back to that journey that we talked about at the beginning.

Since we've been talking about categories, let’s zero in on that journey for one example on the topic of keywords and categories. One word about categories: they are important not just for the strategic purpose – what to write – but also how to market.

You want to have your book in the right aisle of the supermarket. I think Reedsy has a great blog post from earlier about where to place your books. Now, we try to help there with our data, but the point is that you have to make conscious choices. Your book has to be in the right supermarket aisle.

Tactically, it can help with this famous bestseller badge. But mind you, and this is important, there have been changes in recent weeks. It’s a bit back to where we were five years ago, where your book was just allowed in two to three categories and you had the upload categories in your Kindle upload dashboard, which confines it to two industry code categories. Then you could fiddle around with keywords to force the book into specific categories.

Amazon changed that. You can now simply call Author Central or Kindle Support, or send them preconfigured emails and tell them, “Look, I want to put my book into category X, Y, Z in that marketplace,” and they will do so.

Now, up to 10 are still possible, but as said, the backend will basically confine your book to be shown in a maximum of three best seller lists. That is important. You have to make your choices carefully. I don't know whether that this is the precursor of a bigger crackdown into category abuse that's also been going on at Amazon, where basically you don't want to have a high selling book such as Harry Potter found in every bestseller list ranging from sci-fi to sci-fi and fantasy, fantasy and specific, all the way to teen and young adults, parenting, family issues, orphans.

Which has happened because Penguin Random House Publishing has put the Harry Potter books in orphan. So you always found all the Harry Potter books leading in the bestseller list there. If a parent was really interested in reading a nonfiction book about orphans, the only books they'd find at the top of the bestseller list is Harry Potter.

That's obviously not Amazon's purpose with this bestseller list. I think now, after a couple of years, they've finally seen that they have to do something. Now, one brief word also about keywords. This is not a keyword seminar, but also here we've made our observations over the last seven years.

Now, first of all, it's important to note that if you look into things like keywords, there are tools out there. There are things that you can come up with on your own. The important distinction is if you do a search, for example, on Google, then Google registers this. The beauty about Google is actually that they track not only those searches, they harvest all the data. The beauty is they also publish that data.

Especially if you're an advertiser, Google does publish for real the search volume that is happening. For example, if we talked about how many people are looking into Google for how many people are looking for a certain romance genre, then you can either go on Google Trends or you can go into the Google advertising back end and it will give you numbers.

The beauty of those numbers is that they are exact. Just as an example, I'm just opening here this month's romance report and you can look into these keywords over time. For example, the good news is that the search for romance books has been growing over the last five years fairly significantly.

Amazon will say that currently, over the last six months, on average the second highest searches were for college romance books, then fantasy romance books, then romance fantasy books. Then, by the way, mafia romance books and dark romance books. That already gives you an indication that things are getting a bit darker in romance these days.

When it comes to these keywords, i.e. things that people type into Google, there are exact numbers. Now, by contrast, if you go to Amazon, and you start typing romance into the Amazon search bar, you will see that there are suggestions. That's good because all these suggestions will have a specific minimum volume for Amazon to show them.

So if you started trying to look for, say, Amazon slash Z romance, a lot of stuff with that z shows up. But if Amazon only showed two things, or nothing at all, you’d know that's not really being typed in reality. Now, there are tools that help you with harvesting these words.

They have collections, and they also come up with numbers, namely with how many people on Amazon have been looking for this. But this is where the issue is if you want to have a true gauge of demand, because Amazon does not publish these numbers. Now, they do in certain categories, non-book categories, for big advertisers, but not necessarily for the indie author or publisher.

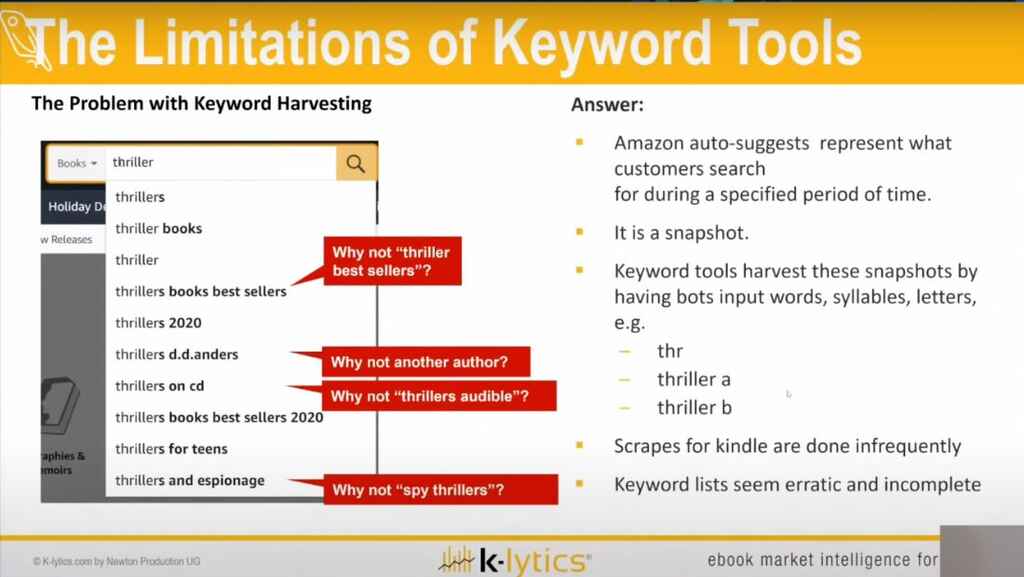

The limitations of keyword tools

Here comes a problem if you suggest, as a final word and keyword. We look at various tools that you can use to see what is being searched for. So if I go look at this month and look at what is the estimated search volume on Amazon for certain terms, there is a myriad of paid and free tools that you can use that will come up with these terms.

Here, the good news here is that it is consistent. Mafia romance is pretty high. But sometimes you also start questioning the validity of these numbers. That's just a point you have to watch out for because whichever tool you use, you have to be aware of the fact that even Amazon has its limitations. When they suggest thrillers 2020, well, why not 2021?

Or, a specific author, why not another author? Or at the very bottom of this list, thrillers and espionage in the top 10 suggestions. Well, why wouldn't people type in spy thrillers? And that's the point. These are momentary observations. Keyword tools harvest those over time and that is good. But if you then look at the volume, for example, one keyword tool will say 4,400 for thriller books.

The next one will be 1,600 for thriller books. Another one will say, 101 searches for this. Another one will say 12,400 for this. You get the idea. Whichever tool you use, you can get bogged down by the numbers.

Understanding the search

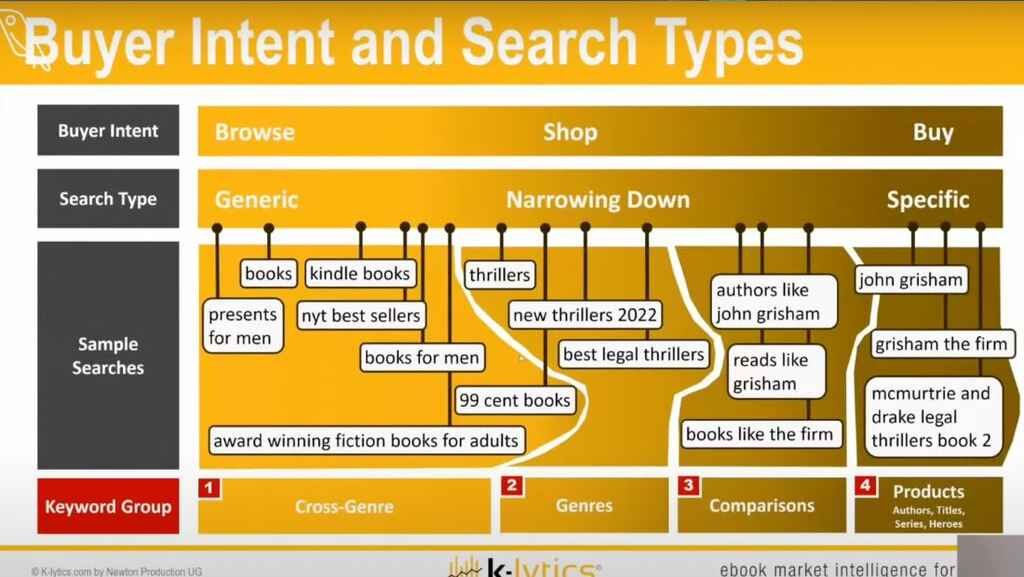

The same applies for our category. Don't get just bogged down by the numbers. Turn on your common sense and try to understand. For example, I propose understanding the syntax of how searches really work.

People may look for thrillers. They may be more specific and look for legal thrillers. They may consider certain attributes and search for new legal thrillers, and not just new ones, a secondary attribute may be top new legal thrillers. They may look for a specific format and a specific thing. We could do a whole seminar just on the syntax or the architecture of what people will actually search for. But keep this in mind when you go looking for making that connection with a reader via categories and keywords.

So think about things such as, what is the intent of my buyer? Is it on the very left hand side, very broad, where a person may type just presents for man?

Or is it narrowing down more specific like books or Kindle books, or is someone searching for best legal thrillers. Or is it on the very right? Is it about comparisons? People may search for “authors like John Grisham” or they are super specific because they've already made up their mind and say “I want to read John Grisham” or even a title, “Grisham the firm.”

In making the connection with your readers, many of you started using Amazon advertising and filled the advertising platform with a myriad of keywords. Before you do, think about this and say, “Do you really wanna compete for a specific ASIN number?” Which basically means you may compete with somebody who already made up his or her mind that they want to read Grisham The Firm. You'd be going head on with a purchasing decision that’s already been made.

So think about this potentially new approach in crafting your keywords to make that connection.

Heat levels on the rise

Over time, volumes for keywords change, categories change, sales change. Over the years we've looked at data across many, many genres. Specifically throughout the pandemic there were changes happening.

Here are just a couple which I found very interesting. I reported on some of them before, but here's the updated data. For example, heat levels are on the rise. I find this striking. The blue line is the last seven years of sales rank of the clean and wholesome romance category. A very, very popular niche category on Amazon.

It continues to thrive. At the same time, here at the midpoint and before Covid, we had a very low point for erotica literature on Amazon. Well, why’s that? Both Facebook and Amazon Advertising heavily restricted advertising for erotica and still do so. But there comes a new channel like TikTok, which is much, much less restrictive concerning steamy content when you go on BookTok, et cetera. All of a sudden you have very steamy, explicitly labeled erotica books rising back up in the Amazon bestseller lists.

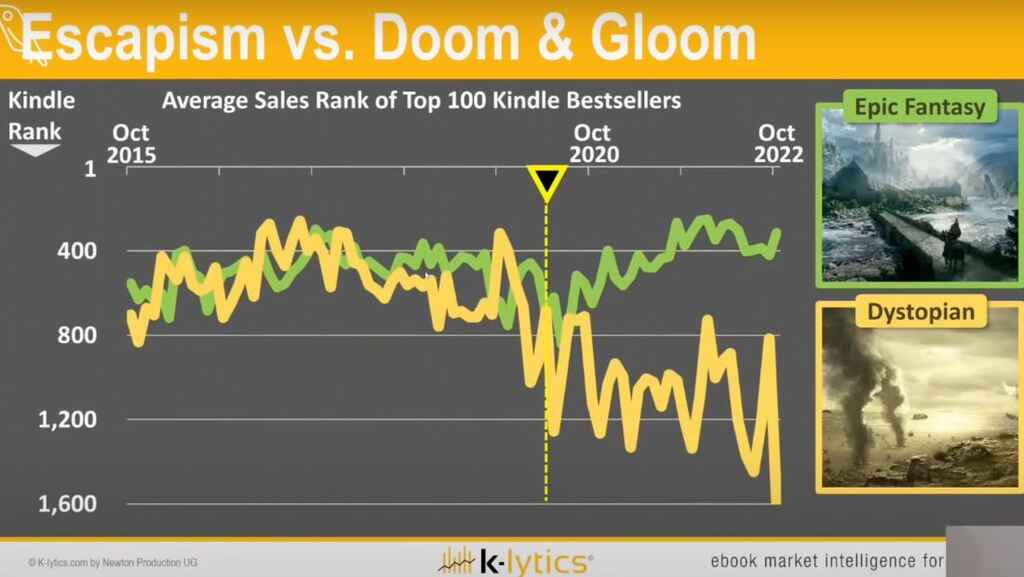

Another example is escapism versus doom and gloom. Especially ever since that little yellow triangle, there has been the rise of epic fantasy, in anything epic, anything fantasy, and potentially a bit more uplifting while dystopian and post apocalyptic are clearly taking a dive.

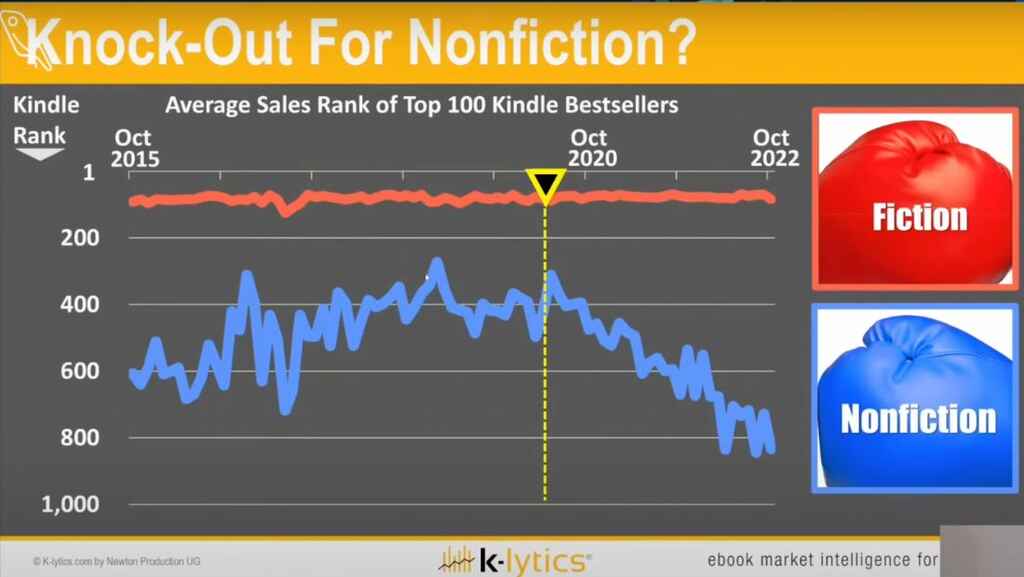

This is an important one and which could lead to a long discussion as well. The red line is the average sales rank of fiction. The blue line is the average sales rank of nonfiction. You see all throughout, even the high time of Kindle Gold Rush, the red line has traditionally outsold the blue line, the many self-help type titles, the biographies, you name it.

Then came the pandemic, the yellow black triangle, and that's when people stopped looking at leadership books and motivational books and perhaps they just wanted to dive into a nice novel. I'm not sure what's entirely at work there. Perhaps also some nonfiction authors are exiting the market because who wants to read the 200,000 laws of attraction books that are only copied from another laws of attraction book.

You get the idea. That is not to be dismissive of nonfiction authors. In fact, there is great, great content and many of my friends are non-fiction authors, but there is something going on that you have to bear in mind if you are into nonfiction.

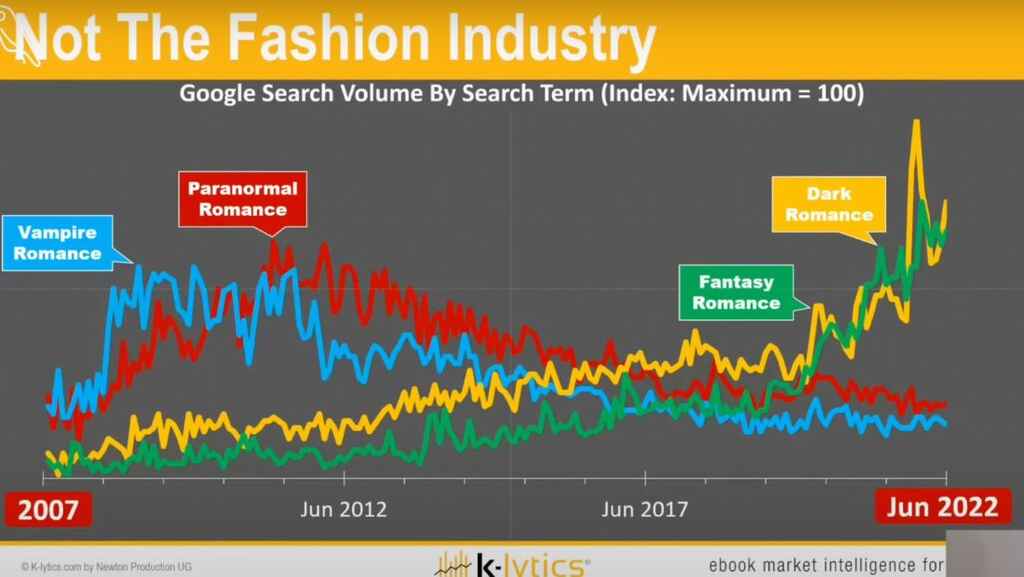

Last not least, you also want to hopefully catch the wave as a writer when you think about the specific topics you write about. So here it is important when you try to make that connection. The good news is that these waves are usually pretty long term. This is an example I tend to show to illustrate this, where I say, thank God the book market is not the fashion industry.

Because you see here this is a picture of 15 years where the line denotes the Google trends, the Google search interest, for specific terms. There's vampire romance in blue. Years later, paranormal romance, the next wave. If you look over the last two to three years, you have things like fantasy romance and dark romance really, really going big, and some evergreen things by the way. Ever since 50 Shades of Gray, billionaire romances are still doing great, five, six, seven years into the whole journey of this genre.

Speaking of journeys, we know it's a big commitment if you are a writer. The whole point of the presentation up to this point was to know your market because you may want to gauge things like trends. Is it trending? Is it big enough? Is it competitive? Is it overcrowded? Is it under-crowded? Is my book project viable? You may want to check on this before you even pick up the pen. The journey can become much, much less painful.

Back to these cogwheels and the journey to connecting with your readers. Now, after that great book is written, you'll also think about other things like book titles, book covers, and also here I want to point out that my accounting teacher always said, “There's no accounting for taste.”

Now, many years later, I ask, “Well, is there or isn't there data in action for cover design?” Don't ask your husband or wife for which book cover he or she likes the most because the fact of the matter is every book market, every target market, comes with certain cover cliches.

You want to specifically meet those cliches because they are what sells. Whether it's domestic thrillers or whether it is paranormal women's fiction, or contemporary western or this very new and dark mafia romance, all have very distinct covers. If you say, “Alex, but that doesn't matter,” well, think again.

Because if you go to our romantic comedy report that we publish every year, we look at the market shares of specific cover designs. If you look at our virtual best seller list of romcom top 500 that we created, flat vector graphic is 41% of the market. A sexy guy is 31% of the market.

In total, we have almost three quarters of the market completely crushed by those two cover designs. Then come all the rest with a girl, a romantic couple or sexy couple, and Mr. Handsome. So your partner in life may say, “Oh, I really like this girl on the cover.” Well, it may work for very specific things like curvy girl romance, but romantic comedy in general, it's just a cover that does not work as well as all the other cover designs.

That's something we've observed not just in one year, but over a five year period.

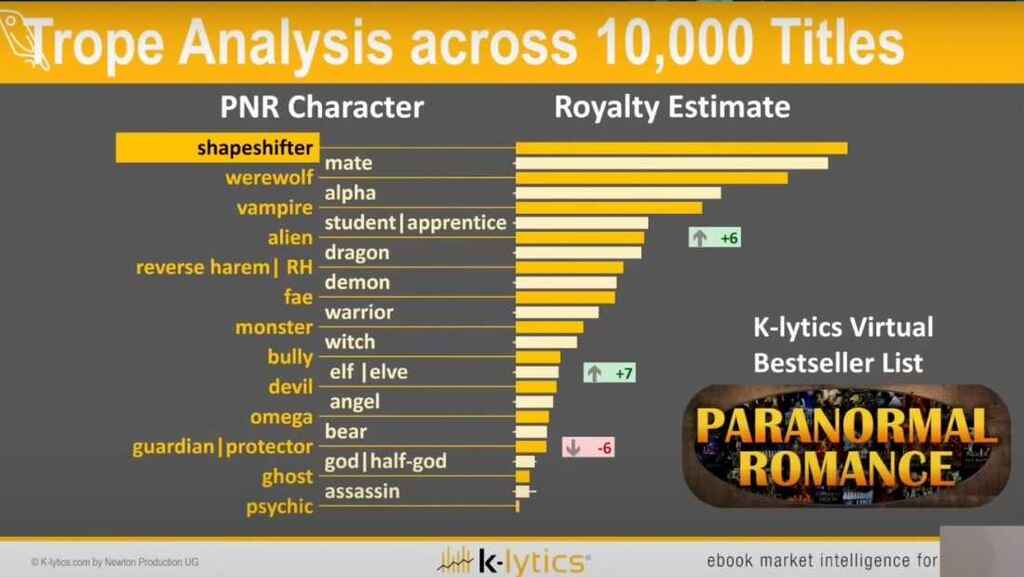

Let's zero in on one other topic. I'm going further left of that journey, even before the great book is written where you plan, where you have your ideas and where you have the craft knowledge and passionate work. Here you can even go into things like, what are trending characters in my specific genre?

Let's say you wanted to write to market in paranormal romance. If I look at the data that we publish in our paranormal romance report, we can see the specific tropes and characters across 10,000 top selling titles over the years, and you see the number one character is the shapeshifter.

Number two is a mate. Number three is a werewolf, then an alpha, then a vampire. We had lots of academy romance, so you have the students and apprentices where you also have an overlap with urban fantasy romance, and you can go down the list. Dragons have been doing fairly well, but at the very bottom of the list you have the more urban fantasy type gods, half-gods, or bear shifters. Interesting, but commercially not as high selling as the more cliche, mainstream type of characters that have made the genre as big as it is these days. I could go on and on and on.

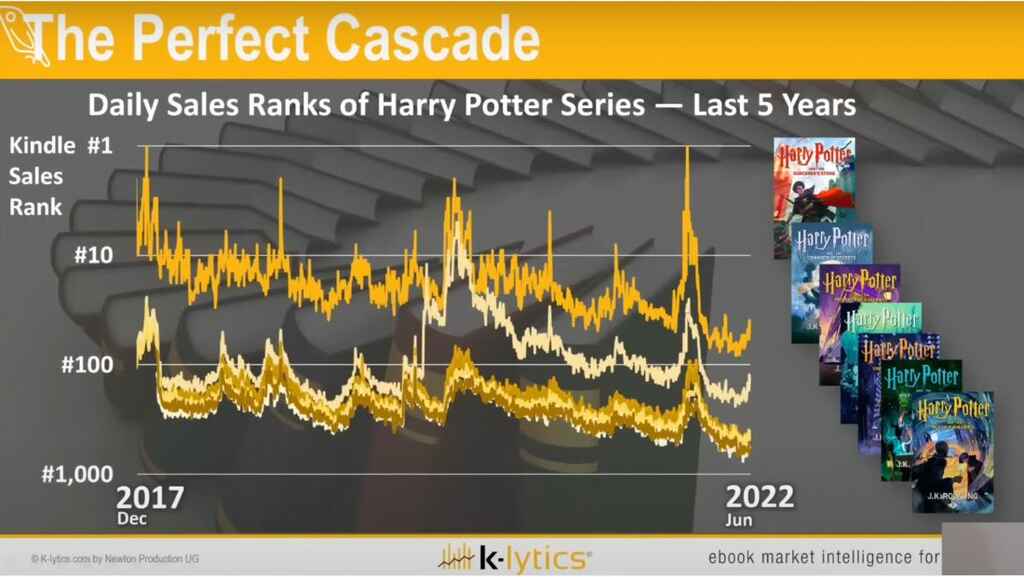

We could talk about the series. Shall I write a series or shall I write a standalone book? Here we have to face up to the market reality that in almost any genre these days, you have a real dominance of series. Back in 2016, we saw more than a third of the books being series across the top 30 main categories. By now, in 2022, it's 45%, and that's a significant increase.

If you go into specific genres, the penetration of series can be even more drastic. For example, in sci-fi and fantasy, 83% of the top selling books are part of a series. If you went into mystery/thriller/suspense in general it is like 59% as per this graph. But also, it can vary in subgenres, where if you go into cozy mystery, we have long series, the Donna Leons of the world with 20 books or more, and they completely dominate the market. Take the big authors in paranormal cozy mysteries, like Emma Chase or Amanda Lees, their series are long and the back lists are humongous.

The output is just amazing. This is something you have to know before you write or when you write in a specific genre. Something like Harry Potter, that's all that we want to write. We looked at the individual sales ranks for the Harry Potter books the last five years, and you can see the specific time when a big promotion was going on.

Harry Potter, dark orange, book number one. You see when that has a peak just hours later or a day later, the second one has a peak, then the third, the fourth, the fifth, and so on and so forth. The marketing of the one title immediately also has a return on investment on the later title.

It seems like common sense, but here you really see the facts of the matter. This is why the series has become so important from an economic point of view.

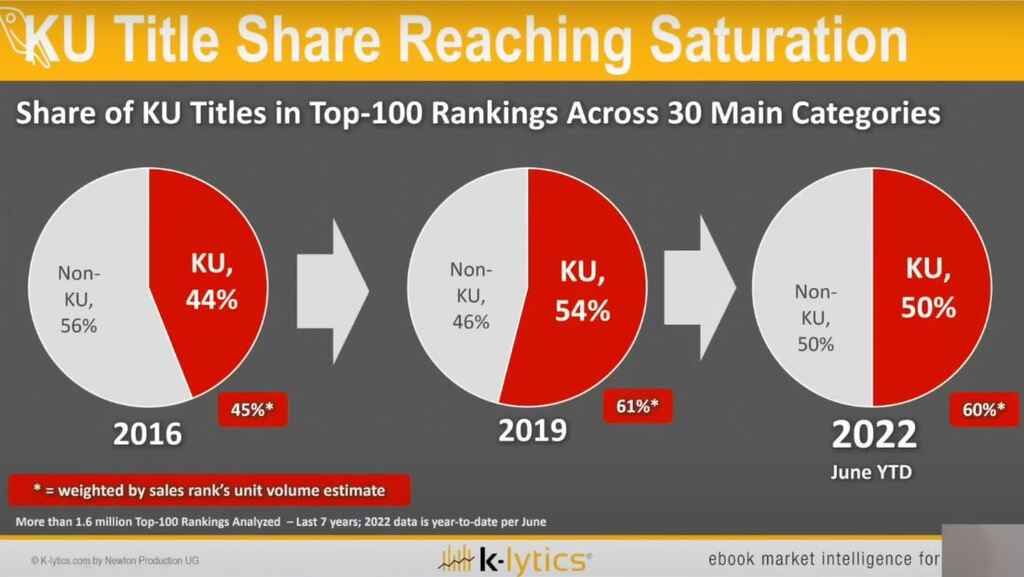

Last topic, perhaps very specialized, but it’s always a question that comes up in the Q and A. KU or not KU, that is the question as Laurence Olivier here would’ve said in 1948. Well, not quite, but the point is KU, Kindle Unlimited, going exclusive with KDP Select, which as an author makes your book exclusive to Amazon for a 90 day period and part of their unlimited borrowing scheme.

The fact of the matter is that the channel has gained share. Back in 2016, we had about 44% of the books across the top 100 main categories in Kindle Unlimited. Now it's 50% and it's gone down again from 2019. So we see a bit of an equilibrium, a balance of the one and the other.

However, it can differ widely by individual genre. If I go back to our monthly category tracking, whichever genre you choose, if you look at the competitive intensity of a specific genre, for example mystery/thriller/suspense, and sorted this in descending order of what the share of book supply is in Kindle Unlimited versus non-Kindle Unlimited, it’s interesting.

For example, number one would be vigilante justice, so the Mark Dawson type of genre, the Lee Child type of genre. In there 72% of the book supply is in Kindle Unlimited versus if I walk the list all the way down, what we monitored here is by contrast the category historical mystery. It's only 29%.

You have to look at your specific subgenre in question to make a choice as to whether you should go into Kindle Unlimited or not, or at least know where the market for that specific subgenre is heading. Of course, if you are in romance, if you go into the bestseller list at a point in time and you take out all the non-Kindle Unlimited books, you're left with this list. Almost the whole best seller list is Kindle Unlimited at that point in time. [In the summer], 77% of the titles were Kindle Unlimited. If you did that for all the genres in romance, over time, 81% on average, so the share is even higher.

Does this mean you have to be on Kindle Unlimited? Yes and no. Depends on the genre. But you also have to distinguish that the bestseller list expresses the number of borrows and the number of sales being made. Since Kindle Unlimited, from a buyer point of view, is essentially free after your paid subscription, these books tend to convert very well, and since they drive the sales rank in the same way as sales, you tend to see a lot of KU books in the bestseller list.

However, you also have a display algorithm that is not based on just sales, namely the so-called popularity lists or the search display results here on the left hand side of this chart.

Here, without going into all the details, let's do a real life example. If you go on Amazon and type romance into the search bar, you will see result number one right here, buy now with one click. It's not on Kindle Unlimited. Next one, buy with one click. Buy with one click. Now comes a Kindle Unlimited title. Now, why would Amazon do that?

Well, the subscribers have already paid, but where can they make new money? From people who are not part of Kindle Unlimited and who may be prepared to buy a book at a full price. The result of that if you do the numbers that the book overlaps between the bestseller list and what you are shown by searching for romance is only 36%.

In fact, 37% of the books are not in KU if you type a search for romance. There's also good news for those of you who decided not to go with Amazon exclusive, and that's another lesson learned here from the last seven years of number crunching.

Last point before we go to the Q and A. As mentioned before, indie authors, you must not be shy of the quality of the books that you are writing.

We had this exhibit before where indies achieve the same, if not better, ratings than traditionally published authors. That's not being dismissive of traditionally published authors. In fact, many of you may be hybrid, doing both, and even if you're just traditionally published, that's a perfect channel.

It's just to say for all of you who are indies, don’t be shy of the quality you achieve. That also means don't be shy of selling your book at the appropriate price. Meaning don't undersell. If we took all of the data for romance from the last seven years, we'd get a picture that looks like this, where we have here the price of love, the price of a romance novel, the average price across the top 100 titles in the romance category.

Yes, there were the days back in 2017 where an individual romance title would go for as low as 2.49 in dollar terms. It was a super competitive time. But look at what hasn't happened ever since. So if your mind is still stuck in the time where you felt, oh my God, all these 99 cent books being out there, that's what is pulling down the price significantly.

That is no longer the case. Why do I think it's no longer the case? Because it's just no longer affordable for authors. Because today for your book to be shown, many of you have to advertise. From a cost point of view, if you sell your book at 99 cents and you make just 35% of this, as opposed to making potentially 70% on a 4.99 book, the economics of your advertising are very different.

Don't be shy of the quality you achieve. I'm not saying you now have to up the price by x number of dollars. Obviously consumers are sensitive to price in current economic conditions anyway, but you get the idea. So with this, don't be shy to use some numbers in your decisions.

If you want to do right to market, you don't have to bend yourself, you don't have to do this. You just have to know the market. That is my big suggestion. Although we've seen a bit of a slowdown this month for the first time with the Kindle Unlimited fund being stagnant, from one to the other, skies are still clear.

If we look at projected growth for this year of the Kindle Unlimited fund as one indicator of the overall ebook market, now that seven months are already in Amazon's pocket or in the author's pockets, we are going to see another, in total, about 526 million dollars paid out in 2022 to indie authors and publishers. That's another 17% growth year on year, which I think in the current climate, even if it's slowing down, is tremendous news. So I hope this gave you a little bit of food for thought. I believe where the numbers and the arts meet, lots of magical things can happen.

I hope that with this you can get on [top of] whatever topic, which book to write, what coverage to choose, what should be the words in my title, what should be my keywords, what should the categories to choose from, the very strategic questions all the way to the very nitty gritty. You can benefit from looking at data.

Of course, if you have more appetite for this, we provide market research done for you. I've shown you a little bit from our monthly category performance database. If you're not into spreadsheets, we have ready-made genre reports that you can buy individually. If you are interested in more, I recommend a membership.

If you just want to get your feet wet and have a bit of a look into what we do, you can have a look into a link that Martin is going to put in the links of the video. That is k-lytics.com/reedsy. This will take you to the Christmas genre reports. They’re still the last edition, but if you sign up there, you will have the new edition, which will come out this month, as well as the up-to-date category performance report for 30 main umbrella categories.

So the sky's the limit. There's already a night sky in Switzerland, many stars to travel with. A big thank you and I’d be happy to take any questions that you may have.