Alex Newton

Alex Newton brings 20 years of industry and management consulting experience. His company K-lytics.com is a leading provider of market research services for authors and publishers. For the past five years, Alex and his team have analyzed millions of books. Why? - So that you do not have to.

This transcript has been edited for length and clarity. For the best experience, watch the video as Alex refers to the slide presentation a LOT. But if you want look at Alex's slide presentation by itself, click here to download it from his site.

Today, we're going to be looking at some market facts and developments and talk about how you, as a writer, can make sense of Amazon data in a way that does not overwhelm you. I'm going to open our K-lytics vault a bit to share some of the latest market data that we measured.

So whether you're an author or publisher, it's going to be good for you to stay tuned to the latest trends.

Art meets science

Before we jump into numbers, it's always important to set the scene. I know many authors, writers, you don't look at numbers all the days, all day long. I had a client who was a former nuclear scientist, so it came very natural to her, but by and large, people want to write their books, they're artists.

But let me tell you that the data and the arts have been closely linked, for many years. You go back to Leonardo da Vinci and you will look at things like the golden ratio and the mathematics of perspective. Where arts meets science, some very interesting things can happen.

So don't be afraid, it's going to be simple, it's going to be fun, and we are going to look into numbers, but in a way that you can digest.

How does the market look?

So with this, let's jump right into the big question. Many of you have e-books published predominantly, I assume on the Kindle market, which is still clearly the market leader. But are e-books as a whole growing or shrinking? So let's look at a number of facts and also some of the indicators.

First of all, you may have heard that as the numbers closed for 2018, the Kindle Global Select fund has grown by some 20% in 2018 and that has been the growth rate for the past two years. So if you take this as one indicator, now about 30% to 35% of the books are in Kindle Unlimited and they generate sales by the page reads.

Unless Amazon is suddenly throwing money at authors, we know that the individual remuneration for an individual page count has been fairly flat. And, assuming that readers are not suddenly reading more pages of their books than before, then you have to assume that also the e-book market here has been growing as well.

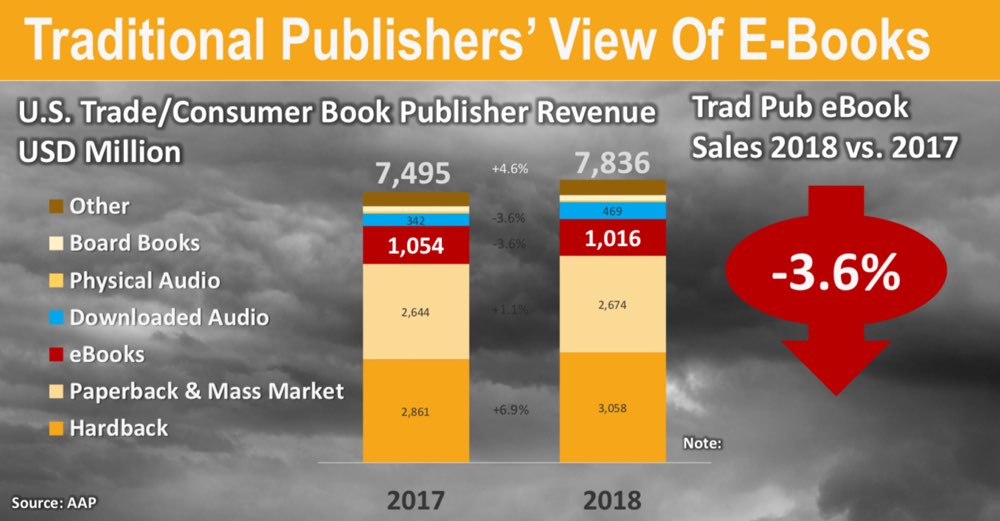

Now having said this, it is important to see that this view of the market, which is all sunshine for e-books, is not shared by everybody. So if we go to the next slide and compare that with the view that the traditional publishers have of the e-books, this takes here the U.S. numbers as a comparison point there. The AAP, the Association of American publishers, they all suggest reported their numbers for 2018 compared to 2017.

First of all you see, if you just look at the size of these bars, you see where they make their money, in value terms, they make about 7.8 billion in revenue in 2018. And the vast majority of it comes from hardback and paperback. So they don't look so much at e-books, in fact, they also do not have so much interest in e-book books growing so much, if you look here where their revenue source comes from.

So in their point of view, when they look at their distribution channels, they measure a slight decrease in e-book sales, 3.6%. And so the question is, what is the truth? The big problem with this sample here of the association is that this association, I think they have about 1,100 publishing companies that report their numbers, but they are all traditional publishers and it doesn't include Amazon. And if you look at the market share of Amazon in the e-book market, some reports say they have more than 80% of the e-book market, then you better go with the Amazon numbers.

Now before I go on, the one thing they do agree though is that we have a huge growth in audiobooks as well and the publishers report a 37% growth here in 2017 to 2018 and we see similar developments on Amazon.

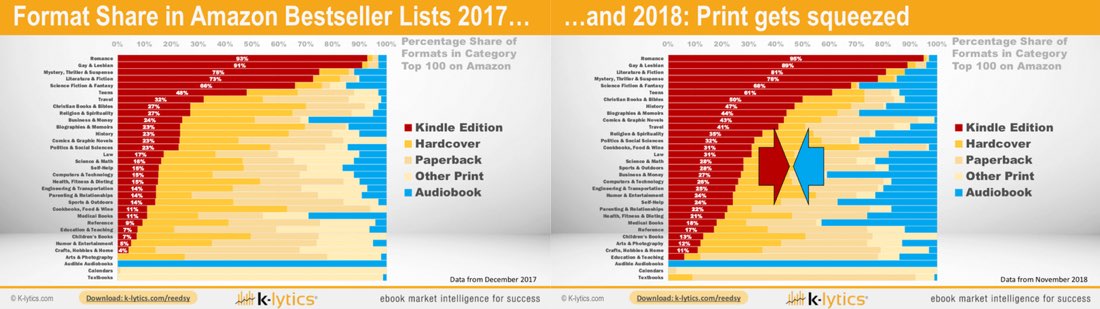

Without going into all the details, what you have listed on the left-hand side is a whole number of genres, about 30 main genres that Amazon has on its store. And the red color that you see is the share of the bestseller lists that represent Kindle editions in their book bestseller lists, which are actually not print bestsellers, but cross format. So you can gauge how much of the top 100 in any genre are what format.

So red is e-book, the yellowish colours are print books and blue is audio books.

You see how in 2018, the red color area has tremendously grown in the bestseller list and so has, coming from the right, the audiobook side. So if you look at Amazon store, they do sell paperbacks and hardbacks, but they sort of continue to get squeezed between e-books and now increasingly also audiobooks.

So from a pure Amazon perspective, we have here, if you look at the high selling, bestseller lists, they have an e-book penetration of more than 70% — partly more than 90%. If you're more into self-help or children's books, you have to go to the bottom of the list, take children's books as an example, which have 7% e-book penetration, so that's something to bear in mind. And especially if you're some of the nonfiction genres, also self-help, there, paperback is still a very important channel.

But the big message is, if you look at these numbers, is that we have continued growth on the Amazon platform of the e-book market, as well as the audio market. So if e-book is growing, the question is and Kindle is such a dominant factor, the big question is, how big is the pot right now, what's the competition and what's in there for the indies before we go into the details?

And there is good news and bad news. When we're talking about the top of the market, we mean books with a sales rank one to 50,000. Out of currently some 5.4 million English speaking Kindle titles, we see another 70,000 titles come online each month. The money is clearly made at the top, in fact, there are estimates that Amazon makes about 1 billion to 1.5 billion in revenue with e-books and the corresponding royalty share and 87% of that, so the vast amount is in that very top. But anything from one to 50,000, experienced authors will know that to get up there into the top 20,000, top 10,000, top 5,000, top 2,000, 1,000, you need to have a good marketing and ad strategy, but that's very much feasible.

How much are indie authors making?

I thought this analysis is very interesting: we took the top 24,000 titles and monitored them over three months to get a fairly accurate picture. We concluded that indie authors, right now, rock. 37% of the market is captured by indie authors. The next single largest market share is the big five combined and then as a single entity, you have very strong and very fast-growing, the Amazon imprints.

So first of all, a big congratulations to all the indie authors out there who are listening right now, because I think you guys did an incredible job. We look at genres every week, every month, we have certain genre reports where we look at top authors and once you leave the big umbrella genre, like mystery, thriller, suspense and romance and you go into the market niches, we suddenly talk about whatever, Amish romance or clean and wholesome romance, you see a lot of indie authors up there.

So indie authors are agile and they really reap quite a bit of that pie. So congratulations to everyone who's had a share in that.

Basics of Amazon data

So the first thing is, where can you look for useful data? If you go into the Amazon store or the Kindle store to be more specific, once you click on the Kindle store, you always have to look at three, four different areas first. And what you're probably most familiar with is the search bar, so when you click on the search bar and click return, you immediately get some data. You get the competitive situation, you get the number of search hits, for example, for the books. If you then were to look at all the individual books that come up and sort them in sales rank order, you would also get a gauge of demand.

Then there are the so-called browse categories: also very useful, because these give you a measure of the level of competition in various genres, down to very granular level. And once you click on a book you get to individual book product pages, which have certain sales ranks information. Then there are the often-forgotten bestseller lists. Sometimes it's a little hard to find, it's up there in the second row beneath the search bar. And this is where you get to all these probably very granular bestseller lists that show the book's performance in a certain genre or a category for the top 100, respectively.

On an individual book page, once you scroll to the bottom, you will see actually two sales ranks or two pieces of information. And many indie authors sometimes get this wrong, because the one at the bottom here is called the so-called category bestseller rank. So it will tell you, hey, here I'm number one in this travel book, hiking and camping, walking category. And the person may have here in this case, a number four bestseller, let's say it's a number one bestseller in that category and he sends these boasting emails around to the friends and family and a Facebook post, "hey, I'm a number one bestseller on Amazon."

True, but that very value is no measure whatsoever of the actual level of sales. In fact, the one thing to really look at whether a book is selling is the AMAZON SALES RANK. This is the rank of the book's sales relative meaning to all the other 5.4 million books on Kindle.

You can be a number one in a category but not sell a single book a day, frankly. So beware of bestsellers that do not sell.

How do the sales ranks work?

The sales rank on Amazon is in its essence a very simple measure.

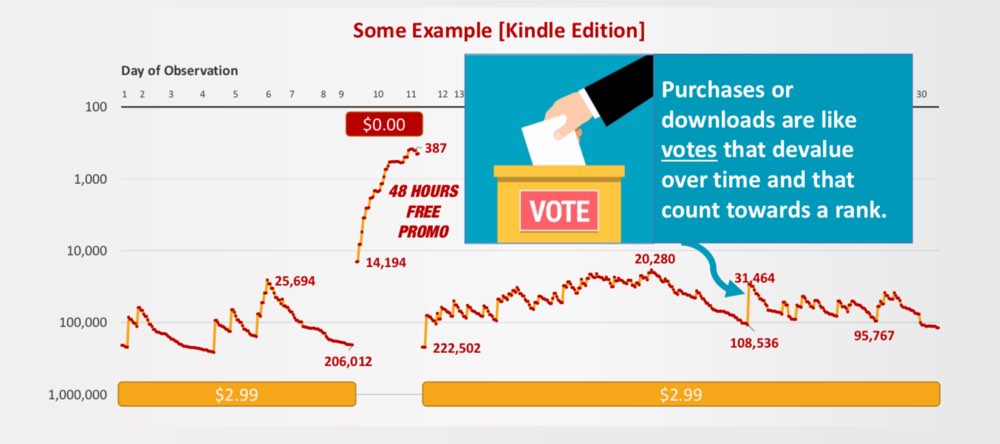

What you see here is small little red dots and these small little red dots plot the sales rank of a given book, not per day, but at any given hour over the day. So it looks like a jigsaw going up down and in its very simplicity, the sales rank is, if you look at where this blue call-out is, with this voting box, where the sales rank jumps up from 108,000 to 31,000. That's the moment when the book had a couple of sales (or only one sale, perhaps) here at this very low level of sales rank.

Purchases or downloads are like votes, but almost like in real politics, the votes devalue over time. Meaning, if you don't continue to sell something, you see the sales rank drops over time. And in those instances, where you get sales and downloads, the thing shoots up again.

So important thing to see in this picture is whether a book is selling or not over time. And what applies to a single book, you also have to do for a genre. So beware of going to the Amazon sales pages and seeing, "Oh, there is this green smoothie book up there, let's publish a book on green smoothies." That may not be the right strategy. You have to look at these averages over time and iron out peaks and valleys of this up and down motion here.

Search versus bestseller list

If you browse through the categories on the left sidebar of Amazon, you get information about the size of categories. And if you put in a search, you will be presented with all books for that given search or that given category, more or less. And the point here is what Amazon presents is not sorted by sales rank. There are other factors, reviews, historical sales, that comes into the algorithm and many other points.

However, if you click through the bestseller lists, here you really get a gauge of demand for the top end of the market. You only at any given point see the top 100 and they are always, always sorted by sales rank. So no measure of reviews or price levels whatsoever. It's unit sales and downloads that drive that rank.

You can then take this information and put it all together.

So for example, we recently did a study on female protagonist mystery and thrillers, for which there is no category, but you can identify the books. And then monitor those over time and get a gauge of the market.

Hot Genres and Market Niches

Once you talk e-books and once you talk Kindle, you have to realise that the bulk of the sales, really the bulk, bulk of the sales is in three major genres:

- romance;

- mystery, thriller suspense; and

- science fiction and fantasy.

Then you can compare those with the umbrella categories where also many books are categorised: literature in fiction and nonfiction.

Then also teen and young adult are still big and growing. And then it really becomes more niche, once you go into religion, spirituality, biographies, you name it. That's where you have real niche markets.

So the good news for those in the niche markets is it is a niche, so competition may also not be as high. Although in the case of religion and spirituality, that category has more than 500,000 in it. So we have to look at both the sales side and the level of competition.

So first lesson learned is romance, mystery, thriller, suspense, teen and young adult: that's where the money is being made. But this is really not to discourage you from a really good nonfiction book.

Some very big categories, very technical categories where say medical authorities upload all their books — there are hundreds of thousands of books in there, but no sale. So that's something to watch out.

Worst-selling categories

If we look at like 7,000 categories, the worst-selling category over the last 12 months is:

- Nonfiction-Crafts, Hobbies & Home-Crafts & Hobbies-Woodworking-Decoys.

(I also had to look it up). So Amazon has a category on duck decoys, which are man-made objects resembling a real duck, which I think you use in hunting, so pretty funny. So if you want to be a number one bestseller, you may want to go for this one, craft, hobbies, mobiles, you get the idea. I mean you find the most obscure nonfiction genres out there and if you write for authority rather than sales, because you say you're the authority for duck decoys, then you may want to write a book and present yourself as a number one bestseller.

You also have to ask automatically, "How many other authors am I competing for in this market?" Once you say you're a publisher (as all self-publishing authors are), you're in there for business. Once you're in there for business, you are exposed to what is called a market. And that market has supply and it has demand and you want to have areas where you ideally have a high level of demand, meaning lots of readers who buy your book, but not necessarily competing with say 34,000 other billionaire romance novels that are already out there.

K-lytics Graphs

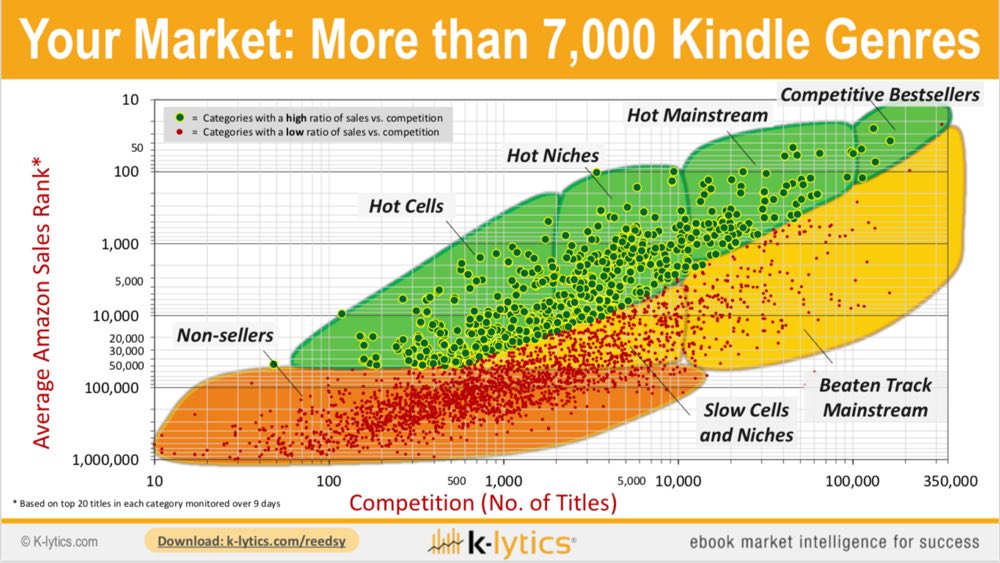

This may look like super complicated, but it's actually very simple and those of you who know K-lytics, you know that's our trademark graph. We call it the K-lytics book strategy map, because every little dot has a position on this graph.

The further it is to the right, the more titles there are in the very category. The higher up it is, the higher the sales. The more you go to the left, the less competition you have, so at the very left hand side it would be anything like 10 to 100 titles in a category. And if you go down, you see the sales rank gets worse and worse.

So there is like a green area, an orange area and a red area. The red area or dark orange area is anything, categories where the top 20 books of the category alone have only an average sales rank of around 50,000, which does not translate into a lot of sales at all.

[note: to see the K-lytics graphs for all the following genres, download the full slide deck from Alex's site]

Romance

The good news is you see a lot of categories: 100 or so just within the main romance branch. And there other romance related ones that we discovered in our romance genre report.

Big romance categories would be things like the paranormal romance. Extremely high sales, so it's high up on the graph. But you see it's pretty much to the right of the graph, meaning there are more than (I think) 30,000, 40,000 titles out there already. So here you have to be have to have a bit of an Amazon marketing budget, AMS marketing budget to get traction.

In the middle it gets more niche, we followed the last three years a very important niche: clean and wholesome romance. It's doing extremely well. It has grown a lot, it's not like too crowded, we've seen a trend of like mainstream romance going into the clean area. People perhaps get a little bit tired of Fifty Shades of Grey and it's also very hard to market erotica on Amazon, especially I think ads are virtually impossible.

And then here to the left hand side things like teen young adult, romance science fiction and dystopian, where you have very successful indies like the Bella Forests of the world. There are extremely high sales, but it's a teen young adult niche market, it's a niche within a niche.

This is basically how this works and you see many successful indie authors, they pick their bets and their start dominating certain niches.

A couple of trends:

It's also interesting to watch individual categories over time. We looked at teen young adult romance science fiction and dystopian, and after 2015 — when Hunger Games and all the other blockbusters movies of the sort started trailing off — so did the book sales. But towards the end of last year, then you suddenly get an upward trend again. And we see the same if you look at this in Google Trends, for the same period of time, you will find us in similar hockey stick. So we look forward to seeing what's going to be happening in that one, in the year 2019.

Romantic Mystery & Suspense is another really strong genre with trad publishers, Amazon imprints and a few very successful indie authors here as well. Over 12 months, sales ranks improved about 46% and it's currently very strong.

Science Fiction and Fantasy

One thing you immediately see in sci-fi is that is has a lot of green dots on our graph. The good news about the green dots is they are arranging from both hot cells — really tiny categories with less than 2,000 titles — to niche markets, to what we call the hot mainstream.

A couple of trends:

You see genres with very successful authors from the sci-fi community, who really have carved out their space whether it's superhero fantasy, military science fiction, or space opera.

Military science fiction has just left the niche stage and has already become more of a mainstream genre. A lot of these writers have a military background. One client of mine is a pilot, so there is some affinity for what people write about and they match this with a supply and demand of a certain market niche.

Humorous fantasy has its own bestseller list, which came out of nowhere, like 18 months ago. Average sales rank are around 20,000, 15,000 and it's climbing. You start looking at these categories and then you see the actual books in it. Sometimes they're a little bit polluted, but still you see what books are driving the trend.

Mystery thriller suspense

I love it, but not just because I read it, but because you see this very high concentration of green dots on the graph, which is good news. These categories offer a lot of opportunity. Yes, they are heavily contested by the traditional publishers and yes, some of these genres have high barriers of entry. So if you want to go into legal thrillers, you have to have legal knowledge and passion about the subject. Yes, you are competing potentially — not with the Grishams of the world — but indie authors who have that knowledge and who can successfully compete.

A couple of trends:

I was surprised, because I that police procedural TV series had tailed off. Book wise, we've seen a still very remarkable increase over the last 18 months and it's already ranking extremely high, but you see that the sales rank has improved on average by another 36%.

Within MTS, we a trend towards domestic thrillers, so psychological thrillers that are in a small environment, household, neighbourhood, vigilante justice. This whole Jack Reacher type of things has been doing well. And we're just updating our study of female protagonist thrillers.

Now cosy mystery is not on there, but they're very successful still, cosy mystery for the usually elder readers in there. And so lots of opportunity in mystery, thriller and suspense.

Fiction vs Nonfiction

Overall, I said the nonfiction e-book sales are lower than the fiction sales, as indicated here by the blue line. But actually the last 12 months has seen quite an increase of nonfiction. Nonfiction had the problem of so many junk books in the gold rush days of Kindle Unlimited when that service first came online. Now, I think we see now a bit of a professionalisation in the nonfiction area of the Kindle market. And also more professional marketing techniques that are being used.

It's going up. You have genres such as for example, business and money titles — thosewere really bad about 18 months ago and now we saw a strong incline.

Within self-help, usually crowded, you will have to look at themes and pockets. If you go into a growing thing like keto diet, well, great, but it's also getting a bit crowded by now.

Sales rank isn't everything in nonfiction

And never forget, especially in the nonfiction area, if you write for the authority, you may be more after the sales rank. So that number one bestseller badge might be more important than actual sales, because you make your sales as a consultant or with an information product website, YouTube channel, you name it. Don't forget a multi-channel strategy and print books to add to the equation.

Conclusion

If you are a writer and you publish your book, you become an author, very simply put. If you publish it yourself, you're a self-publisher — but if people buy the books, you are professional. If you do it for a living.

And once you are an indie publisher, the second you use the word publisher in your designation and get involved in publishing yourself or with the help of others, such as Reedsy, but you are in essence a business. And as a business, you will look at sales, you will look at your costs and hopefully return a profit. And once you talk about profit, you will talk about markets, where you have others who want to have the same profit, that's competition. And you have readers who represent your demand.

And looking at this data can help you with basically two things.

What to write

So if you have a clean sheet of paper, you wonder, "shall I go into nonfiction or into fiction?

"If I'm in fiction and I am in romance, I'm in paranormal romance, what is the next thing? Is it the shifters, the vampires, the ghosts, the angels?" If these are your questions, the data can help you.

How to market it

And on a more tactical level, obviously, you can measure also keywords, you can measure categories. If you have the book in the wrong categories, it would never even show up. So this is where the data can help what to write and how to market.

If you have any questions, leave them in the comments below